Divorce And Life Insurance Policies

This may depend upon the financial obligations between the parties such as alimony child support and other financial issues that may be contained in the divorce settlement agreement or ordered by the court. Each month when you make your premium payment a portion of that money enters a.

Divorce And Life Insurance Policies

Divorce And Life Insurance Policies

Meanwhile 462 of the working public has a life insurance policy with 40 of these joint policiesat the convergence of these two statistics is a thorny financial and legal matter.

Divorce and life insurance policies. There are also riders to these policies such as accidental death and dismemberment. Whole life builds cash value universal life provides some flexibility to payments variable life has a stock market component and group life is usually provided by an employer. Divorce and life insurance.

What you do with a life insurance policy after a divorce. Some life insurance policies particularly whole life and universal life policies accumulate cash value over time. What happens to a life insurance policy after a divorce.

The following answers regarding divorce and life insurance policies can help you identify and understand some of the issues that need to be considered during divorce negotiations. Generally speaking term life also called temporary life policies are cheaper at the start making them a good option when money is tight. Upon divorce it is important to review the beneficiary designations on existing life insurance policies and make any necessary changes.

Divorce is not only an upset for your family it can throw up unexpected financial difficulties too. If you find yourself in this situation youll need to think about how to manage any existing life insurance policies you have jointly or separately. Life insurance for divorced couples.

If you have a term life policy you wont have to worry about splitting the policy up as an asset during the divorce. Among those details you might need to think about are any life insurance policies you may have either jointly or singly and what to do with them when you separate. There are many types of life insurance depending on your goals and needs.

Divorce is a difficult time for everyone involved with a lot to consider and manage. Here are some of the things youll want to consider. 42 of marriages in england and wales end in divorce.

Term policies are your standard life insurance policies. They do not come with any supplemental components and have no cash value. When considering how to use life insurance in your divorce the first consideration is whether you want a whole life or a term life policy.

There is no one right way to manage your life insurance policy as part of a divorce settlement.

Life Settlements Guide Selling A Life Insurance Policy

Life Settlements Guide Selling A Life Insurance Policy

/GettyImages-991166232-2aef8023fa454bed815e9cce55d19db5.jpg) 7 Documents You Ll Need As Your Prep For Your Divorce

7 Documents You Ll Need As Your Prep For Your Divorce

John And Jane Doe Were Married For 20 When They W Chegg Com

John And Jane Doe Were Married For 20 When They W Chegg Com

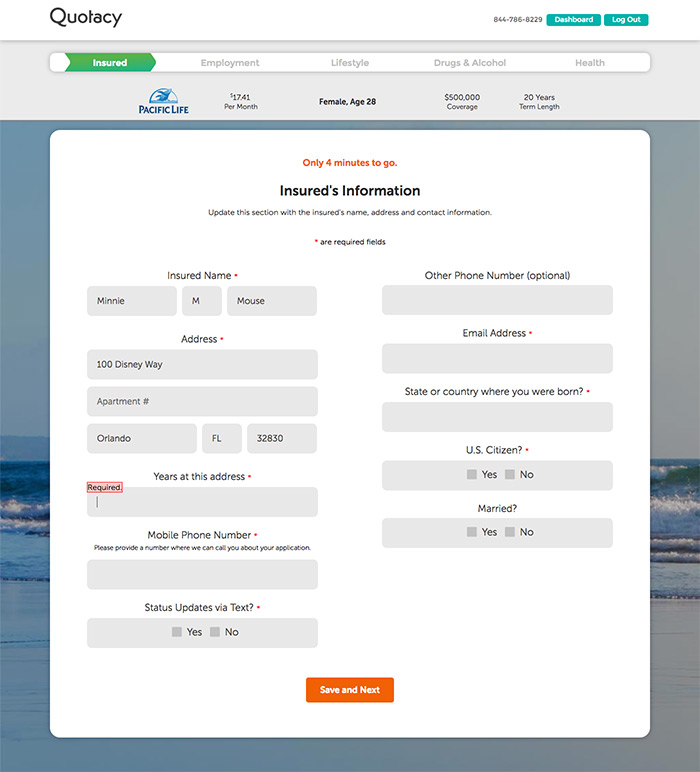

Are Life Insurance Premiums Tax Deductible Quotacy

Are Life Insurance Premiums Tax Deductible Quotacy

/72472453-56a0f46b5f9b58eba4b58617.jpg) Rules Regarding Car Insurance And Divorce

Rules Regarding Car Insurance And Divorce

Life Insurance Beneficiary Rules Texas Boonswang Law

Life Insurance Beneficiary Rules Texas Boonswang Law

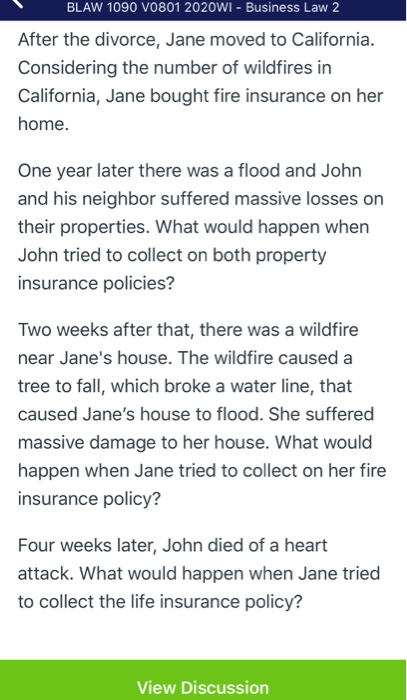

During The Divorce Should I Keep My Spouse On My Life Insurance

During The Divorce Should I Keep My Spouse On My Life Insurance

/GettyImages-112260467-479cdfb54c484e6893648d0b99604412.jpg) How Life Insurance Works In A Divorce

How Life Insurance Works In A Divorce

Beneficiaries Presented By Uaw Fca Ford General Motors Legal

Beneficiaries Presented By Uaw Fca Ford General Motors Legal

Are Life Insurance Policies Public Record

Are Life Insurance Policies Public Record

Dividing Federal Retirement Pensions In A Divorce Fers Csrs Etc

Dividing Federal Retirement Pensions In A Divorce Fers Csrs Etc

How Does Life Insurance Work During A Divorce Policygenius

How Does Life Insurance Work During A Divorce Policygenius

102 Best Life Insurance Images Life Insurance Life Insurance

102 Best Life Insurance Images Life Insurance Life Insurance

Divorce Does Not Change Life Insurance Beneficiaries

Divorce Does Not Change Life Insurance Beneficiaries

What Occurs To Your Life Insurance Coverage Policy In A Divorce

What Occurs To Your Life Insurance Coverage Policy In A Divorce

Can I Buy Life Insurance On Someone Else Quotacy

Can I Buy Life Insurance On Someone Else Quotacy

Life Insurance Policies Divorce And Life Insurance Policies

Life Insurance Policies Divorce And Life Insurance Policies

Types Of Life Insurance Policies

Types Of Life Insurance Policies

Insurance Concerns Of Divorcing Couples

Insurance Concerns Of Divorcing Couples

Drafting Divorce Agreements To Address Life Insurance Obligations

Drafting Divorce Agreements To Address Life Insurance Obligations

Unwinding An Irrevocable Life Insurance Trust That S No Longer

Unwinding An Irrevocable Life Insurance Trust That S No Longer

Post a Comment for "Divorce And Life Insurance Policies"