Fixed Universal Life Insurance

The fixed indexed universal life fiul product is a flexible premium universal life insurance policy that may possibly be the ideal solution for protecting your dreams while helping you reach your long term financial goals. Here we discuss what is fixed indexed universal life insurance.

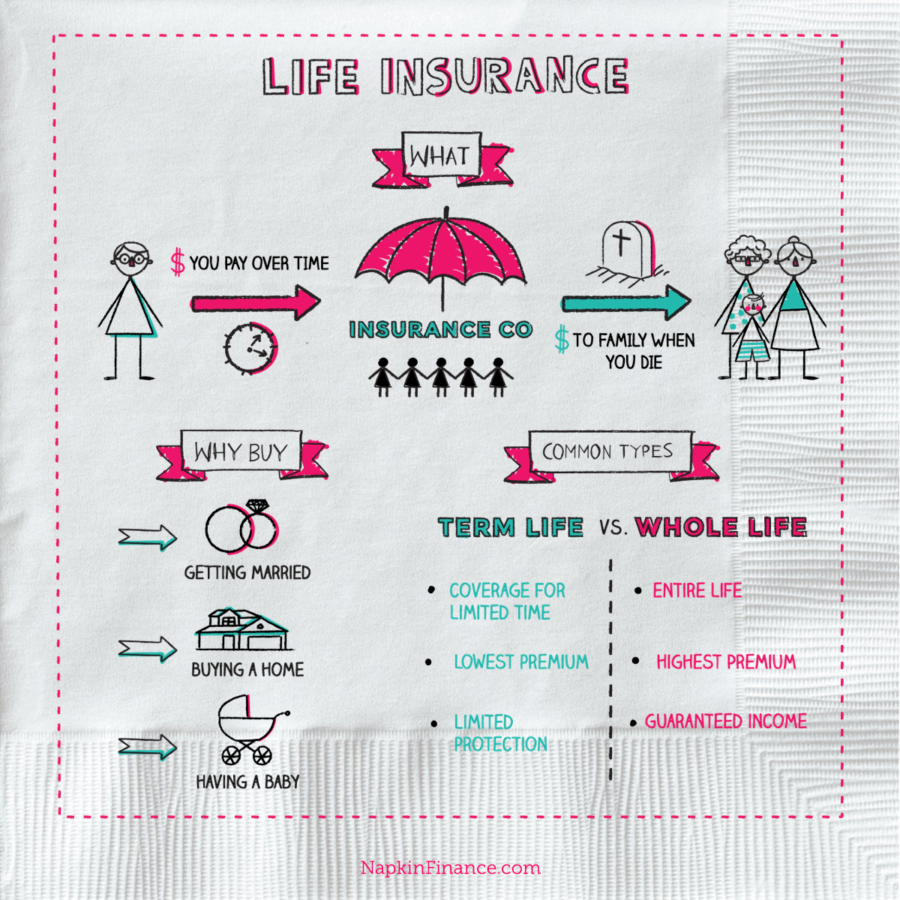

What Are The Different Types Of Life Insurance We Have The Answer

What Are The Different Types Of Life Insurance We Have The Answer

This is a permanent type of coverage that keeps your rates level throughout the length of the policy.

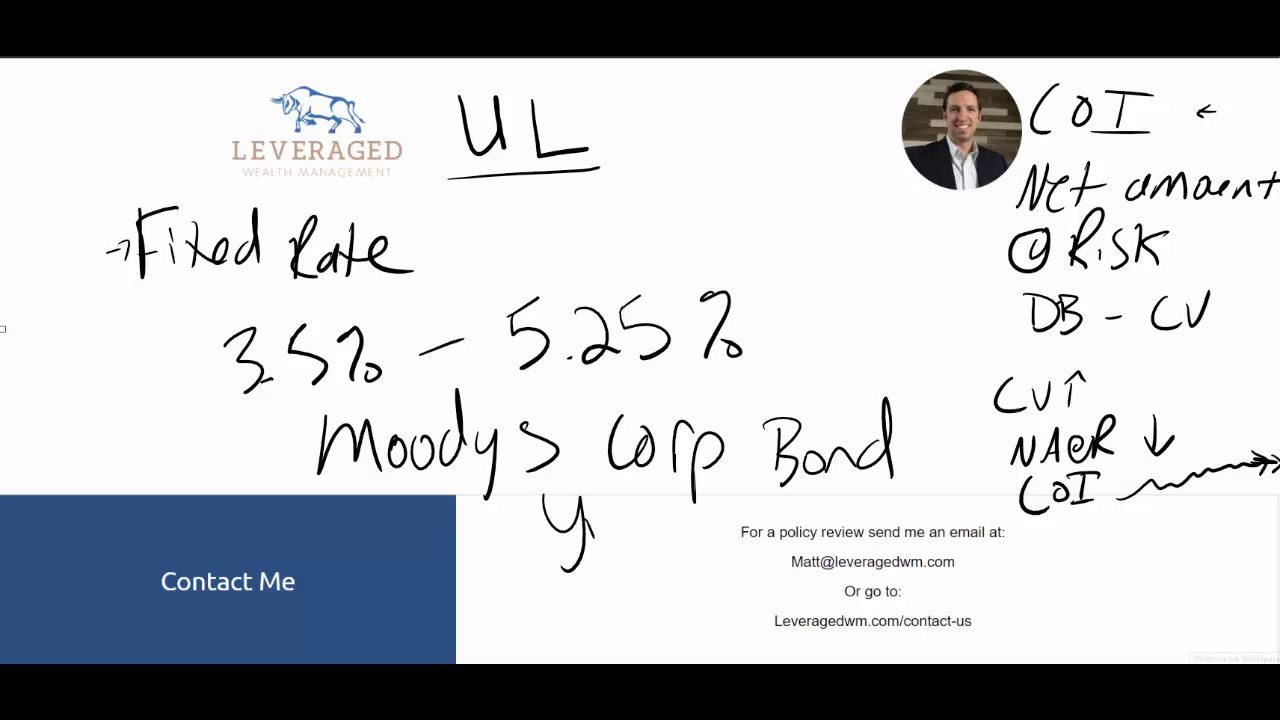

Fixed universal life insurance. Under the terms of the policy the excess of premium payments above the current cost of insurance is credited to the cash value of the policy which is credited each month with interest. Indexed universal life iul. Most universal life insurance policies contain a flexible premium.

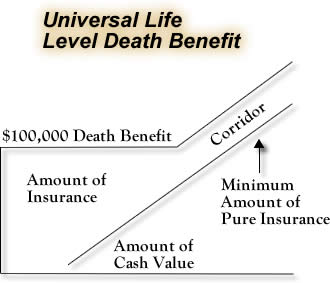

The devil is in the details and when you really examine them it becomes clear that these are products designed to be sold not bought. Indexed universal life insurance provides death benefit protection and the opportunity to build money inside your policy called cash value based in part on the increases of market indexes. Universal life insurance often shortened to ul is a type of cash value life insurance sold primarily in the united states.

Indexed universal life insurance iul is an insurance product that seems to promise you can have your cake and eat it too. Universal life insurance comes in many different forms from your basic fixed rate policy to variable models that allow the policy holder to select various equity accounts in which they can invest. Universal life insurance is permanent life insurance with an investment savings element and low premiums like term life insurance.

Flexible premiums allow you to adjust your payments or you can choose a fixed amount. Unfortunately as with most things in life there are no free lunches. Universal life insurance ul comes in a lot of different flavors from fixed rate models to variable ones where you select various equity accounts to invest in.

Guaranteed universal life insurance. Fixed life is another label for whole life which combines life insurance and savings into one account. Lifetime protection for your loved ones.

Guaranteed universal life insurance or gul or also known as a permanent term because it technically does carry an expiration date. Term life insurance is a defined policy that guarantees a benefit payout if the covered person dies during the policy term. Fixed universal life is less risky than other universal life policies so its growth potential is the most limited.

Variable Universal Life Insurance Protective Life

Variable Universal Life Insurance Protective Life

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

Indexed Universal Life Review Iul Tax Free Retirement Youtube

Indexed Universal Life Review Iul Tax Free Retirement Youtube

Universal Life Insurance Combines Elements From Te Chegg Com

Universal Life Insurance Combines Elements From Te Chegg Com

:max_bytes(150000):strip_icc()/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg) Universal Life Insurance Definition

Universal Life Insurance Definition

Universal Life Coverage Human Resource Management

Universal Life Coverage Human Resource Management

Is Fixed Indexed Universal Life Insurance A Good Or Bad Investment

Is Fixed Indexed Universal Life Insurance A Good Or Bad Investment

Guide To Do Universal Life Insurance Policies Work Life

Guide To Do Universal Life Insurance Policies Work Life

What Is Guaranteed Universal Life Insurance And How Does It Work

What Is Guaranteed Universal Life Insurance And How Does It Work

What S The Lowdown On Variable Universal Life Insurance Text Word

What S The Lowdown On Variable Universal Life Insurance Text Word

Cash Value Life Insurance Universal Life Explained Youtube

Cash Value Life Insurance Universal Life Explained Youtube

Universal Life Insurance Aig Direct

Fixed Index Annuities Vs Indexed Universal Life Insurance

Fixed Index Annuities Vs Indexed Universal Life Insurance

Fixed Universal Life Insurance Success Financial Freedom

Fixed Universal Life Insurance Success Financial Freedom

Your Financial Bunker Life Insurance

Your Financial Bunker Life Insurance

Life Pro Advantage Fixed Index Universal Life Allianz Life

Life Pro Advantage Fixed Index Universal Life Allianz Life

Term Vs Universal Life Insurance Term Vs Universal Life

Term Vs Universal Life Insurance Term Vs Universal Life

/life-insurance-policy-185263144-5759a4013df78c9b46e39aed.jpg) Comparing Different Types Of Life Insurance

Comparing Different Types Of Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

:max_bytes(150000):strip_icc()/GettyImages-685006799-dc14e32358e948a5830aac92b4e631c2.jpg) Universal Life Insurance Definition

Universal Life Insurance Definition

Whole Life Insurance Vs Variable Universal Life Vul Risky Or Safe

Whole Life Insurance Vs Variable Universal Life Vul Risky Or Safe

Post a Comment for "Fixed Universal Life Insurance"