Do You Have To Pay Income Tax On Life Insurance

In fact life insurance benefits and certain other types of insurance payments are assigned to a separate special income class. Heres a primer on what to do if your life insurance beneficiary dies before you.

How To Get Income Tax Benefits From Your Life Insurance Cover

How To Get Income Tax Benefits From Your Life Insurance Cover

Your whole life or variable life insurance policy could be a source of cash while youre still alive.

Do you have to pay income tax on life insurance. But there are certain. Do i have to pay income tax on life insurance payouts. There are certain forms that you may have to fill out when you pay taxes on life insurance benefits.

However if the total value of your estate is more than 325000 inheritance tax iht will be deducted from your insurance pay out at a rate 40. You will want to check with the irs and use forms such as 1099 r to report any taxable part of the benefits that were received. If you decide to transfer a life insurance policy that you currently have into an irrevocable trust do not wait.

However the countrys tax code doesnt treat life insurance payouts as regular income. If you have taken out life insurance to provide a lump sum or regular income to your loved ones when you die there is usually no income or capital gains tax to pay on the proceeds of the policy. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away.

How to calculate taxable income when cashing out life insurance pre death. Sometimes life insurance payouts are paid to the estate of the deceased rather than directly to a beneficiary. If youre in line to receive life insurance benefits there are a few things that you should keep in mind.

Most of the time proceeds arent taxable. Life insurance is designed to provide a safety net for your loved ones when you die a cushion upon which they can continue to lead normal. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

The irrevocable trust must be the owner of your policy for at least 3 years at the time of death to avoid any estate taxes being assessed. This may occur if the policys beneficiary dies before they can receive the payout and there are no other beneficiaries. Each policy has a.

Do You Have Enough Life Insurance Landsberg Bennett

Do You Have Enough Life Insurance Landsberg Bennett

Philippines Life Insurance Income Before Taxes Gen Expenses

Avoiding Taxes On Life And Disability Insurance Wsj

Avoiding Taxes On Life And Disability Insurance Wsj

Download Instructions For Irs Form 1120 L U S Life Insurance

Download Instructions For Irs Form 1120 L U S Life Insurance

This Is How To Claim As Much As Possible For Your Tax Refund

This Is How To Claim As Much As Possible For Your Tax Refund

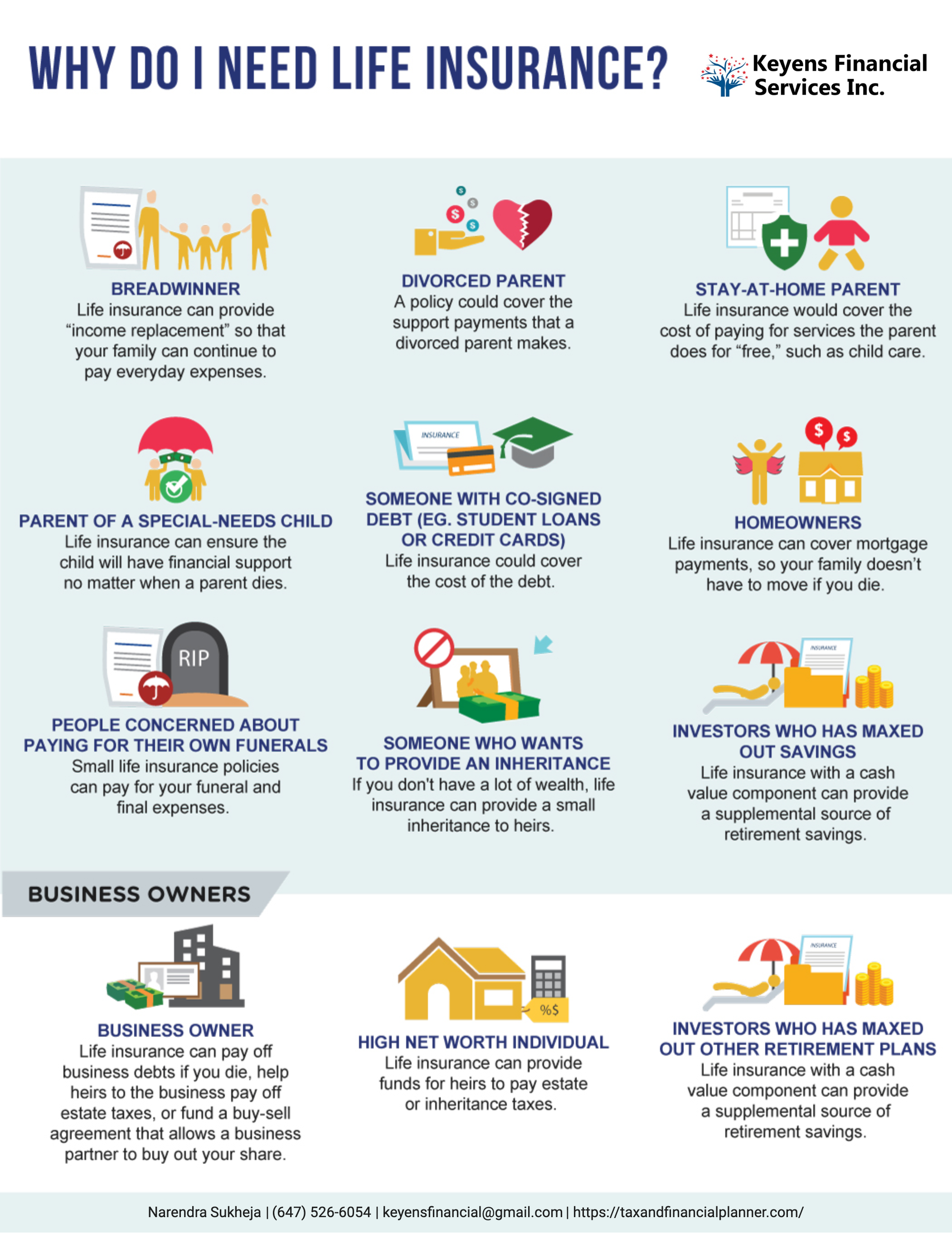

Do You Really Need Life Insurance Keyens Financial Services Inc

Do You Really Need Life Insurance Keyens Financial Services Inc

Ownership Structures For Life Insurance Policy Funded Buy Sell

Ownership Structures For Life Insurance Policy Funded Buy Sell

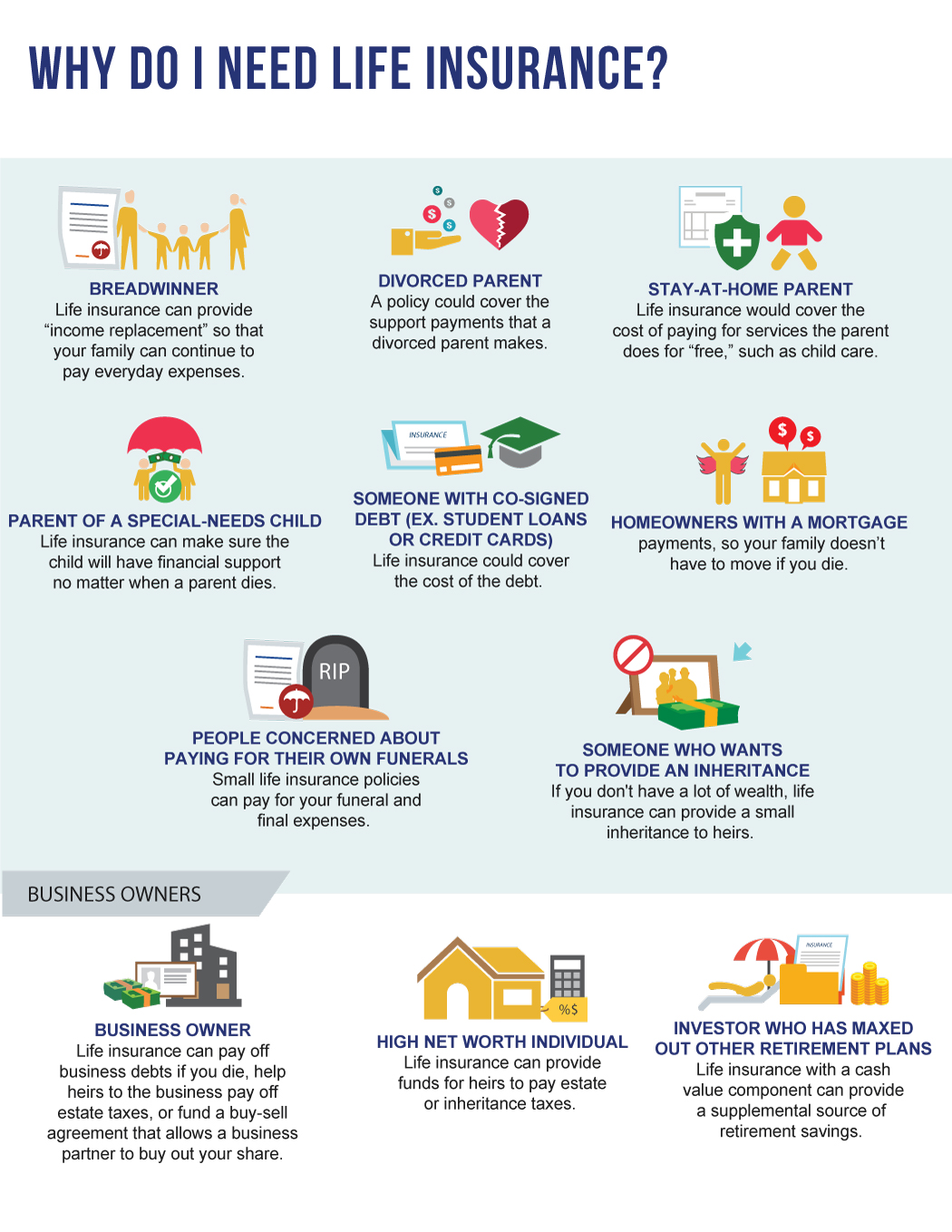

Do You Really Need Life Insurance Legacy Wealth Advisors

Do You Really Need Life Insurance Legacy Wealth Advisors

Income Tax Deduction And Exemption To Insurance Policy Planmoneytax

Income Tax Deduction And Exemption To Insurance Policy Planmoneytax

Avoid Surrendering Life Insurance Policy 1

Avoid Surrendering Life Insurance Policy 1

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

Do Beneficiaries Pay Taxes On Life Insurance

Do Beneficiaries Pay Taxes On Life Insurance

Everything You Must Know About Tax Benefits Of Medical And Life

Everything You Must Know About Tax Benefits Of Medical And Life

Income Tax Return For Lic Agency Agent Itr 3 Only Form 16a

Income Tax Return For Lic Agency Agent Itr 3 Only Form 16a

Lic Online Payment Through Banks Paytm Cards Offline Agent

Lic Online Payment Through Banks Paytm Cards Offline Agent

Life Insurance Merriken Financial Group

Life Insurance Merriken Financial Group

How Your Lic Premiums Can Help You Save Income Tax

How Your Lic Premiums Can Help You Save Income Tax

Financial Planner Strategies To Reduce Volatility And Improve Tax

Financial Planner Strategies To Reduce Volatility And Improve Tax

Budget 2019 Tweaks Taxes On Insurance Maturity Proceeds

Budget 2019 Tweaks Taxes On Insurance Maturity Proceeds

Medical Expenses Deductions Health Insurance System Ibm Japan

Medical Expenses Deductions Health Insurance System Ibm Japan

Life Insurance And Taxes Bestow

Life Insurance And Taxes Bestow

Federal Income Tax In Its Relation To Life Insurance Companies

Federal Income Tax In Its Relation To Life Insurance Companies

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg

Post a Comment for "Do You Have To Pay Income Tax On Life Insurance"