Disability Rider Term Life Insurance

What is a term insurance rider. Should you buy a disability rider on life insurance.

Take The Next Step With Disability Insurance Principal

Take The Next Step With Disability Insurance Principal

In such a situation your life insurance coverage would continue but you will no longer have to pay the premiums while you cannot work.

Disability rider term life insurance. For instance a waiver of premium rider will allow you to continue your term life coverage for a limited time if you are unable to pay the premium. If you have a rider which waives the premium it will make a lot of sense in the long term. With the disability income rider youll still have the same life insurance policy you bought nothing will change about the term of the amount of the death benefit.

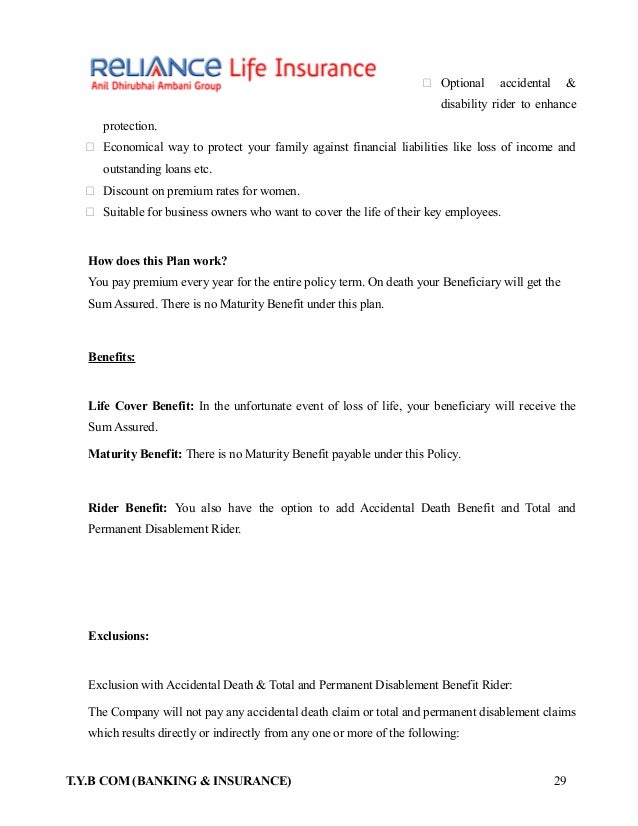

Transamerica life insurance offers the option to add the monthly disability income rider on their trendsetter living benefits term life insurance coverage. Trendsetter living benefit is a unique type of coverage as it can provide tax free income from the policys death benefit for any qualifying critical chronic or terminal illness. When you buy a life insurance policy for an additional fee a rider can be added to the contract that waives the premium payment if the insured becomes totally disabled.

A term rider offers you additional benefits over and above the pre decided sum assured of your policy in case a scenario that is covered by the rider occurs. A disability income rider is a very valuable add on available to policy owners when they purchase a life insurance contract. A disability income rider provides financial protection to the owner of a life insurance contract that a disability will often incur.

It does so in a couple of ways potentially depending upon your life insurance company. Its hard to say any one rider is right for everyone but there are riders that are useful for the majority of people whether because they offer the most coverage or provide the greatest price protection. If you buy a disability rider with your life insurance you wont be required to pay your policys premiums in the event of a disability that prevents you from working.

A disability income rider is an optional add on to a life insurance policy that allows the insured to stop paying premiums in the event they become disabled for at least six months. Depending on the particular rider the policyholder may also receive monthly income payments at a rate of 1 percent of the full value of the policy. Long term disability insurance riders recommended for most.

In other words the. Each life insurance company will have a different idea of what constitutes disability so make sure to read all the fine print. Purchasing a rider is a great way to cover the expenses related to disability and loss of income.

Term insurance rider is an attachment or amendment to an insurance policy that supplements the coverage in the policy. When you buy life insurance online you can consider the cost of a rider and then make a decision. A term rider is an add on benefit you can attach to your existing term insurance policy at a nominal rate.

What To Know About The Waiver Of Premium Rider Haven Life

What To Know About The Waiver Of Premium Rider Haven Life

Your Guide To Choosing Effective Life Insurance Riders

Your Guide To Choosing Effective Life Insurance Riders

Are You Aware About The 4 Essential Life Insurance Riders

Are You Aware About The 4 Essential Life Insurance Riders

Lic Accidental Death And Disability Benefit Rider Uin

Lic Accidental Death And Disability Benefit Rider Uin

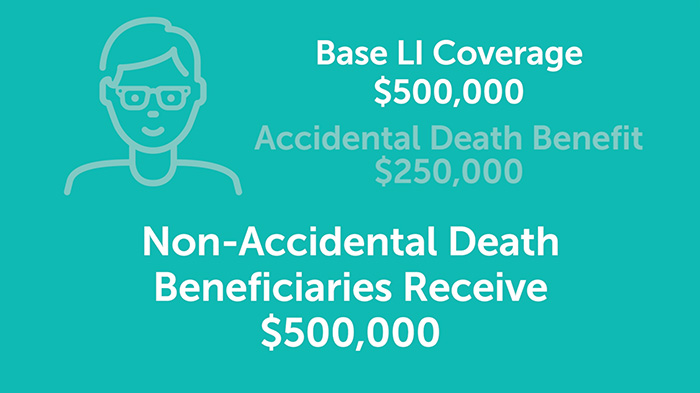

What Are Term Life Insurance Policy Riders Quotacy

What Are Term Life Insurance Policy Riders Quotacy

What Is A Living Benefits Life Insurance Rider Haven Life

What Is A Living Benefits Life Insurance Rider Haven Life

Do You Need A Personal Accident Insurance Plan Personal Finance

Do You Need A Personal Accident Insurance Plan Personal Finance

15 Best Guaranteed Universal Life Insurance Companies Reviewed

15 Best Guaranteed Universal Life Insurance Companies Reviewed

The Cost To Add Children To Your Term Life Insurance Quotacy

The Cost To Add Children To Your Term Life Insurance Quotacy

How Riders Can Make Your Life Insurance Cover More Beneficial

How Riders Can Make Your Life Insurance Cover More Beneficial

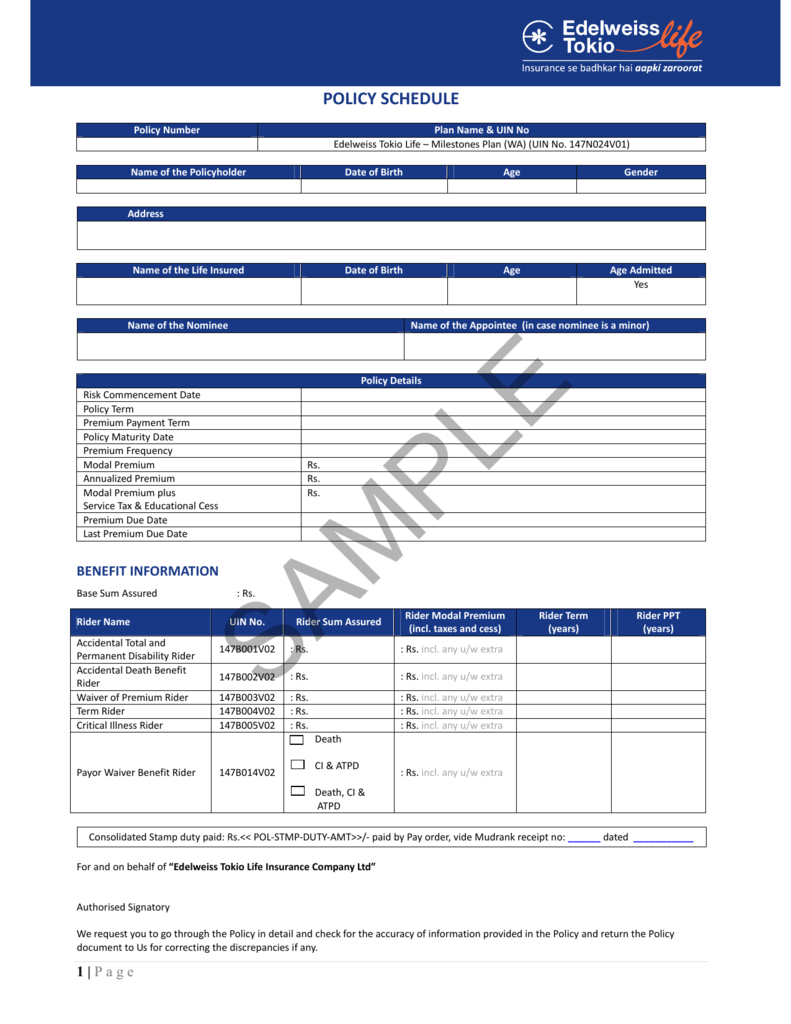

Sample Policy Contract Edelweiss Tokio Life Insurance

Sample Policy Contract Edelweiss Tokio Life Insurance

7 Life Insurance Riders To Consider

7 Life Insurance Riders To Consider

How To Decide If That Life Insurance Rider Is Worth It Nerdwallet

How To Decide If That Life Insurance Rider Is Worth It Nerdwallet

Term Insurance Enhance Your Term Cover With Accidental Death

Term Insurance Enhance Your Term Cover With Accidental Death

I Am 28 Years Old And Want To Buy Rs 1 Crore Term Life Insurance

I Am 28 Years Old And Want To Buy Rs 1 Crore Term Life Insurance

What S New This Week 17 May 2019

Ssq Term Life Insurance Life Health Invest

Ssq Term Life Insurance Life Health Invest

/GettyImages-1096534502-1e91213e8ae04b9cb0cb1aaac7cecfae.jpg) What Is A Waiver Of Premium For Disability

What Is A Waiver Of Premium For Disability

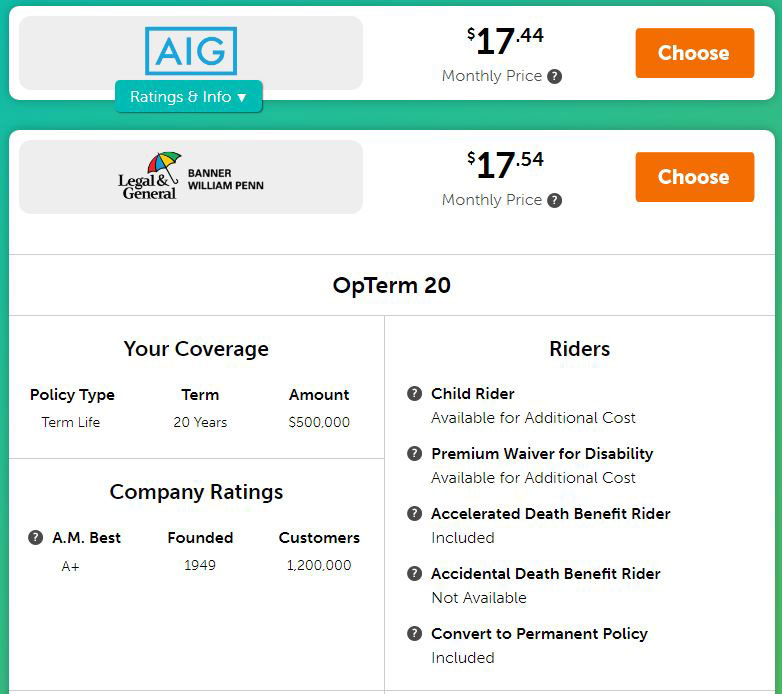

Term Life Insurance Carrier Name Of Product Issue Ages Minimum

Term Life Insurance Carrier Name Of Product Issue Ages Minimum

Post a Comment for "Disability Rider Term Life Insurance"