Estate Tax Life Insurance

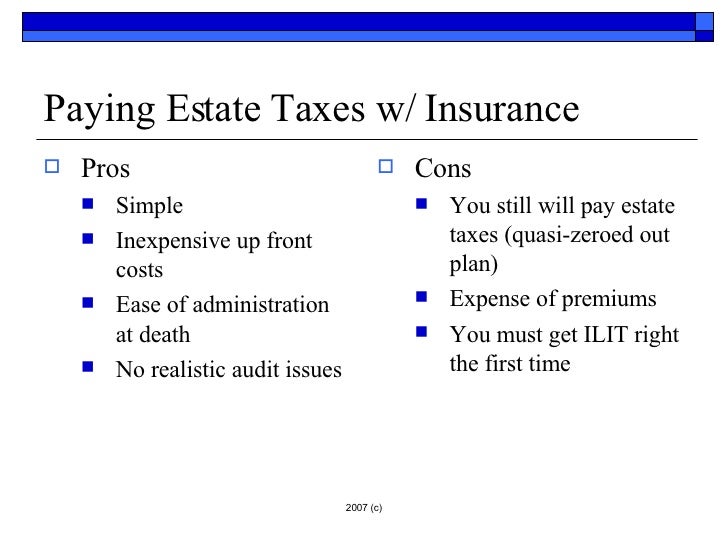

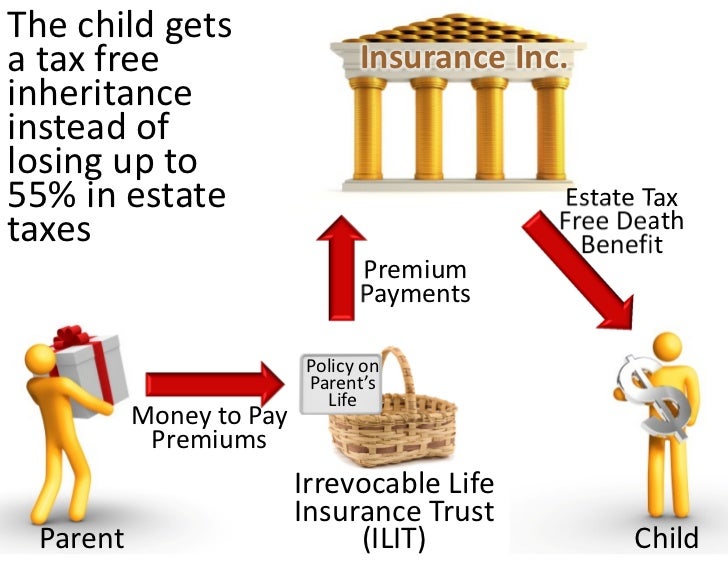

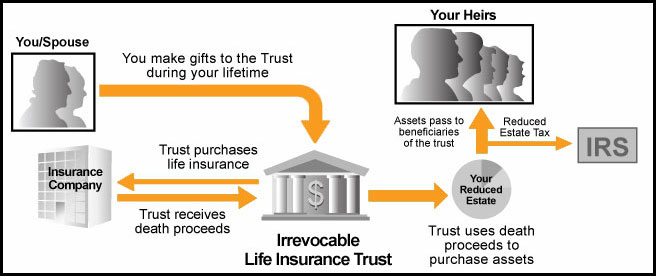

To avoid taxation of your life insurance policy you cannot own your own life insurance policy. It follows that if you want your life insurance proceeds to avoid federal estate tax you may wish to transfer ownership of your life insurance policy to another person or entity.

Life Insurance And Estate Tax Presentation

Life Insurance And Estate Tax Presentation

If at least one of the designated beneficiaries survives the decedent the life insurance proceeds pass directly to the beneficiary outside of probate.

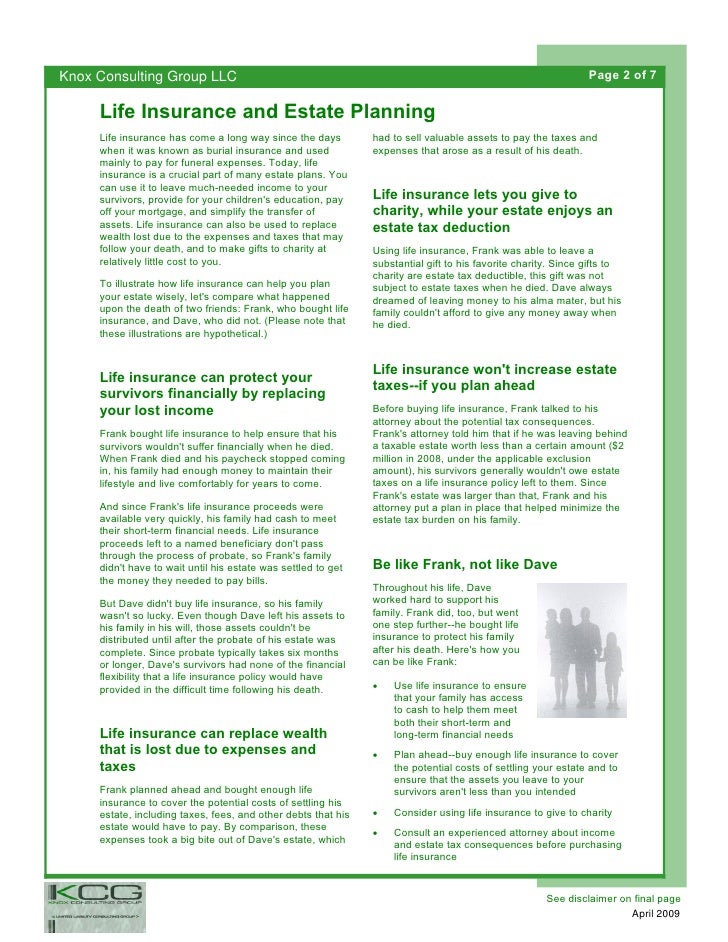

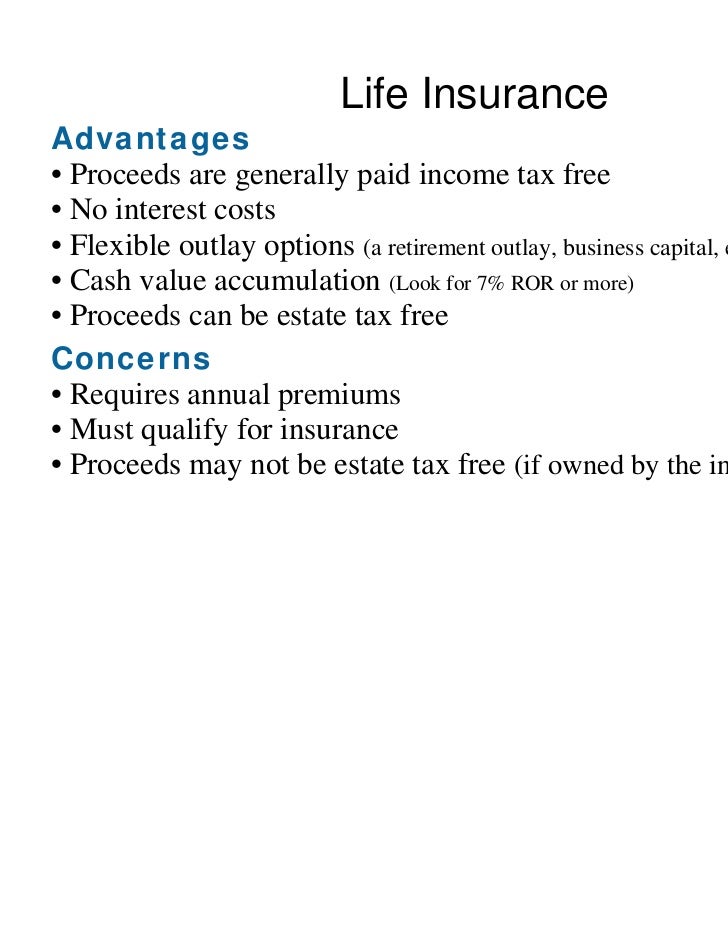

Estate tax life insurance. If having life insurance death benefits included in your taxable estate would cause an estate tax hit the tax planning solution is to set up an irrevocable life insurance trust to own the policy. Some combinations are delightful like chocolate and peanut butter. Is life insurance subject to estate tax.

How to avoid taxation on life insurance proceeds prevent the tax man. The death benefits paid on life insurance policies are subject to estate tax in two situations. To avoid paying taxes on the payout of your life insurance policy you must separate your life insurance policy from your estate.

First if the death benefit is paid to the estate of the insured then the whole amount of the death benefit is included in the estate and subject to estate tax. If you have significant assets understanding. Life insurance and estate tax.

If your net worth has increased since you took out your policy or you havent compensated for the jump in the estate tax rate from 35 percent to 40 percent which happened in 2012 you may wish to compare life insurance quotes on additional coverage. This may also mark a good time to review your life insurance coverage. You can transfer ownership of your policy to any other adult including the policy beneficiary.

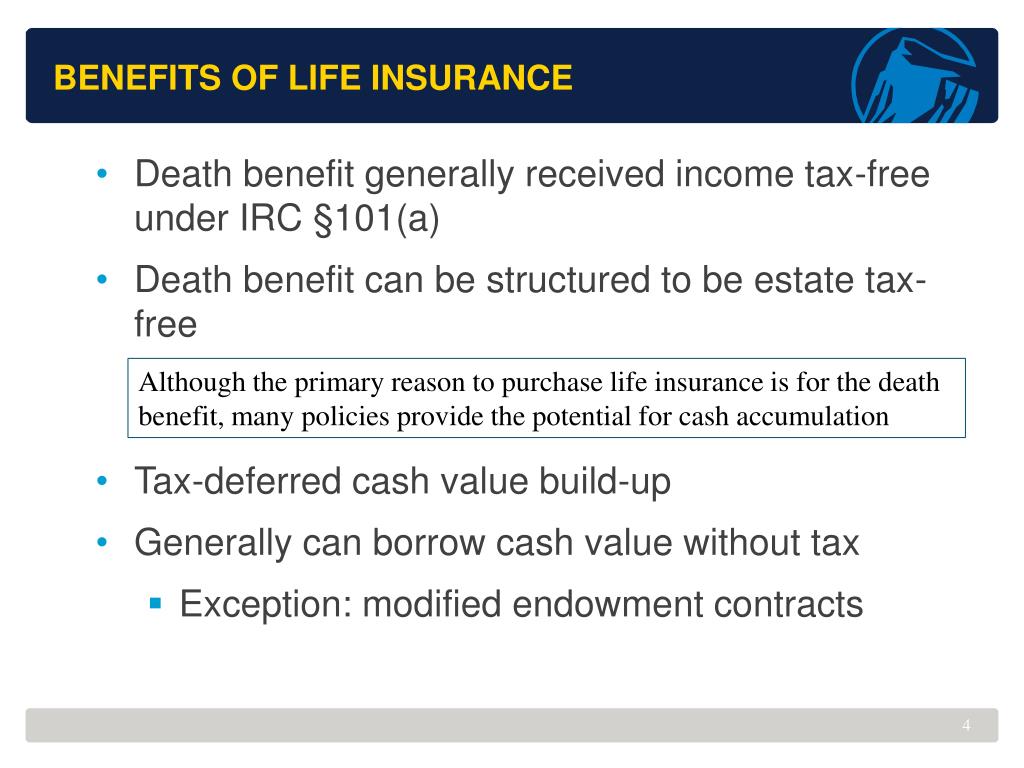

When life insurance is part of an estate a life insurance policy has one or more designated beneficiaries if the decedent completed a beneficiary designation form for the policy before their death. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. Heres how it works life insurance ownership and estate tax.

The exemption and rate were scheduled to revert to the 2002 figures of a 1 million exemption and a 55 estate tax. There are two ways to do it. But when life insurance mixes with estate taxes the results can be good or bad.

Some people who have just recently come into or currently possess large estates and who retain life insurance might not be aware of how life insurance proceeds can affect estate taxes.

Avoiding Taxes On Life And Disability Insurance Wsj

Avoiding Taxes On Life And Disability Insurance Wsj

Ppt A Dozen Uses Of Life Insurance In Estate Planning Powerpoint

Ppt A Dozen Uses Of Life Insurance In Estate Planning Powerpoint

Life Insurance One Of The Few Remaining Tax Free Benefits

Life Insurance One Of The Few Remaining Tax Free Benefits

Life Insurance And Estate Tax Presentation

Life Insurance And Estate Tax Presentation

Life Insurance Charitable Remainder Trusts

Life Insurance Charitable Remainder Trusts

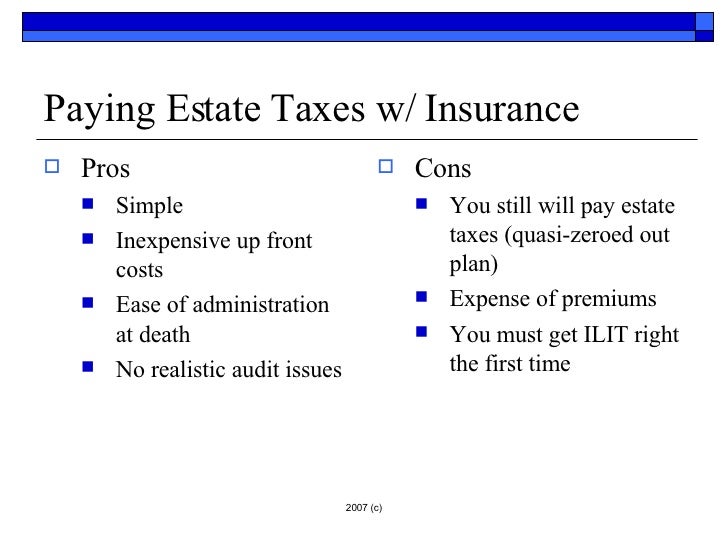

Using Life Insurance In Zero Tax Estate Planning

Using Life Insurance In Zero Tax Estate Planning

Life Insurance In A Changing Tax Environment M Financial

Life Insurance In A Changing Tax Environment M Financial

Chapter 6 Estate Tax Pdf Free Download

Chapter 6 Estate Tax Pdf Free Download

Life Insurance Proceeds And Estate Tax Businessmirror

Life Insurance Proceeds And Estate Tax Businessmirror

Understanding Life Insurance Trusts Disability Insurance For

Understanding Life Insurance Trusts Disability Insurance For

Federal Gift Estate And Generation Skipping Transfer Taxation Of

Federal Gift Estate And Generation Skipping Transfer Taxation Of

3 Tips For Setting Your Family Up With Your Estate Planning Save

3 Tips For Setting Your Family Up With Your Estate Planning Save

Does Estate Tax Exemption Apply To A Life Insurance Payout

Does Estate Tax Exemption Apply To A Life Insurance Payout

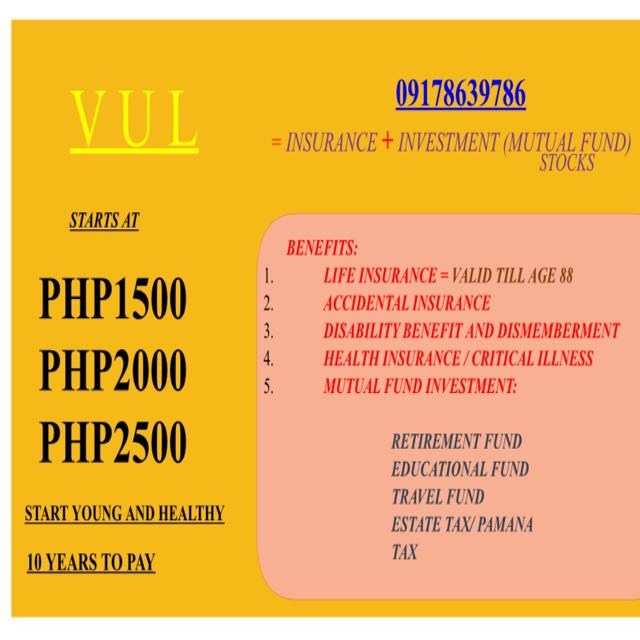

Estate Tax Planning 101 In The Philippines Life Insurance In

Estate Tax Planning 101 In The Philippines Life Insurance In

Do You Have Enough Life Insurance Landsberg Bennett

Do You Have Enough Life Insurance Landsberg Bennett

Estate Planning Using Life Insurance Moneytalkph

Estate Planning Using Life Insurance Moneytalkph

Life Insurance Estate Tax Update For 2020

Life Insurance Estate Tax Update For 2020

Are Life Insurance Proceeds Subject To Estate Tax

Are Life Insurance Proceeds Subject To Estate Tax

Life Insurance As Estate Planning Tool My Wise Finances

Life Insurance As Estate Planning Tool My Wise Finances

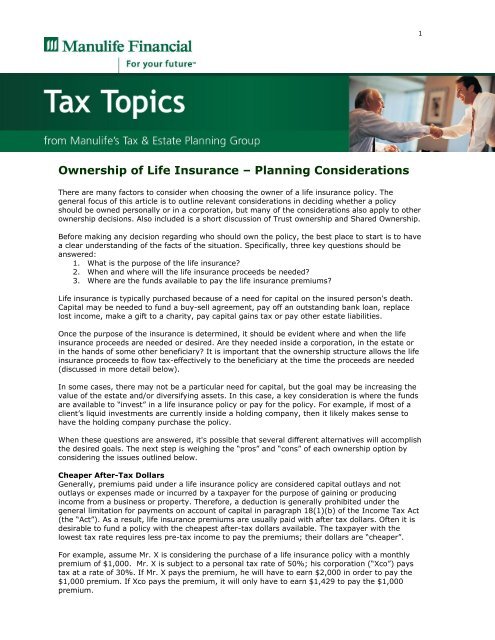

Ownership Of Life Insurance Repsource Manulife Financial

Ownership Of Life Insurance Repsource Manulife Financial

Does Life Insurance Become Part Of The Estate Quora

Does Life Insurance Become Part Of The Estate Quora

Post a Comment for "Estate Tax Life Insurance"