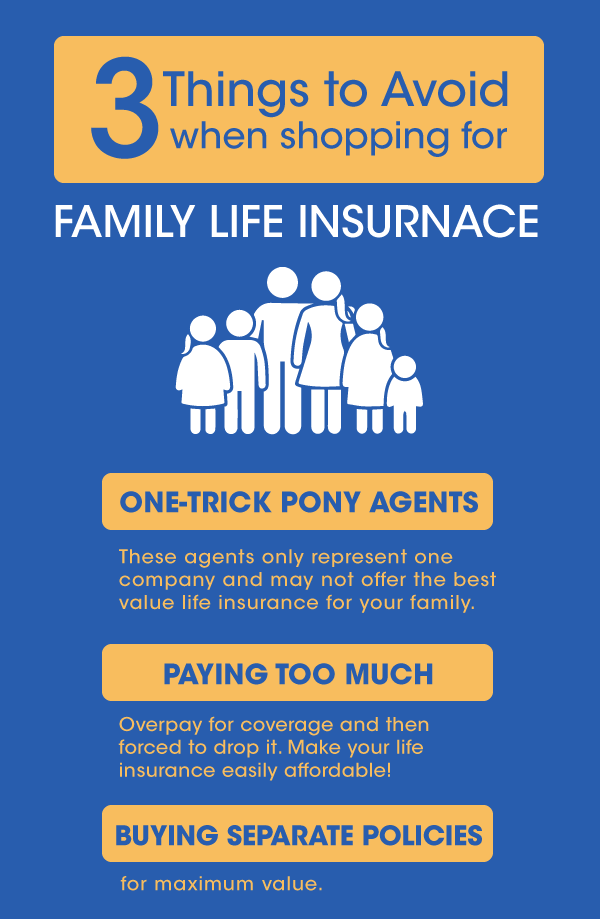

Define Life Insurance Policy

In exchange for premium payments the insurance company provides a lump sum payment known as a death benefit to beneficiaries upon the insureds death. An agent can be independent agent who represents at least two insurance companies or a direct writer who represents and sells policies for one company only.

Life insurance policy synonyms.

Define life insurance policy. Define life insurance policy if you are looking for the easiest insurance quote online then this free service is available just for you. When choosing a life insurance policy two of the main types of plans available are term life insurance and whole life insurance. Depending on the contract other events such as terminal illness.

The policy holders buy insurance cover from an insurance company and pay specific periodic amounts premiums for the term duration or life of the policy. Define life insurance policy. Define life insurance policy if you are looking for insurance that will help you feel protected then our insurance quotes can provide you with options that are right for you.

Insurance promise of reimbursement in the case of loss. Paid to people or companies so concerned about hazards that they have made prepayments to an insurance company. Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a death benefit to named beneficiaries upon the death of the insured.

Insurance cover that serves two major purposes. Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. A life insurance policy is a contract with an insurance company.

Typically life insurance is chosen based on the needs and goals of the owner. Definition of life insurance policy. 1 to substitute for the insureds income if he or she dies and 2 to qualify the insured for favorable tax treatment.

Life insurance resource center glossary of life insurance terms agent an insurance company representative licensed by the state who solicits and negotiates contracts of insurance and provides service to the policyholder for the insurer. Define life insurance policy if you are looking for an easy way to get insurance quotes then our service provides you with a convenient way to get the information you need. Contract between a life insurance company the insurer and the entity buying the policy the insured or policy holder.

In england they call life insurance life assurance life assurance.

Solved 4 An Insurance Agent Plans To Sell Three Types Of

Solved 4 An Insurance Agent Plans To Sell Three Types Of

One Life Insurance Policy Can Have Two Nominees

One Life Insurance Policy Can Have Two Nominees

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Life Insurance For Your Family 5 Tips To Creating The Perfect

Life Insurance For Your Family 5 Tips To Creating The Perfect

7 Most Important Principles Of Insurance

7 Most Important Principles Of Insurance

Life Insurance Stock Photo Image Of Business Finances 6613934

Life Insurance Stock Photo Image Of Business Finances 6613934

Smoking And Term Insurance Pages 1 3 Text Version Anyflip

Smoking And Term Insurance Pages 1 3 Text Version Anyflip

Term Life Insurance How It Works

Term Life Insurance How It Works

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

Financial Planning With Life Insurance Ppt Download

Financial Planning With Life Insurance Ppt Download

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

Quiz Worksheet Life Insurance Policies Study Com

Quiz Worksheet Life Insurance Policies Study Com

Tax Benefit Is Your Single Premium Life Insurance Policy Eligible

Tax Benefit Is Your Single Premium Life Insurance Policy Eligible

Life Insurance Check Out Best Insurance Polices 10 Feb 2020

Life Insurance Check Out Best Insurance Polices 10 Feb 2020

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Life Insurance Policies Various Life Insurance Policies

Life Insurance Policies Various Life Insurance Policies

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg) Whole Life Insurance Definition

Whole Life Insurance Definition

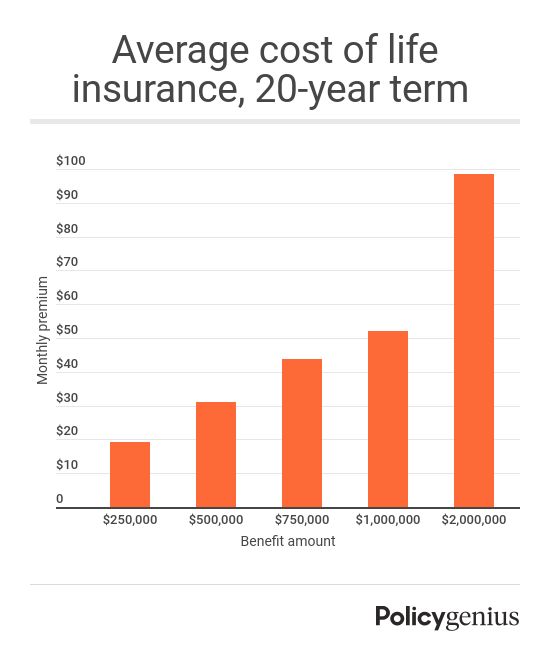

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

Endowment Vs Whole Life Insurance Difference And Comparison Diffen

Endowment Vs Whole Life Insurance Difference And Comparison Diffen

Annuity What Is An Annuity How They Work Icici Prulife

Annuity What Is An Annuity How They Work Icici Prulife

Can Life Insurance Claims Be Denied For Drug Overdose Advisor

Can Life Insurance Claims Be Denied For Drug Overdose Advisor

Post a Comment for "Define Life Insurance Policy"