Definition Of Life Insurance

Life insurance definition insurance providing for payment of a sum of money to a named beneficiary upon the death of the policyholder or to the policyholder if still living after reaching a specified age. Life insurance is defined as a contract between the policy holder and the insurance company where the life insurance company pays a specific sum to the insured individuals family upon his death.

Life Insurance Definition Youtube

Life Insurance Definition Youtube

The policy holders buy insurance cover from an insurance company and pay specific periodic amounts premiums for the term duration or life of the policy.

Definition of life insurance. Term life policies have no value other than the guaranteed death benefit. A life insurance policy that is active for the entirety of the policyholders life. The life insurance sum is paid in exchange for a specific amount of premium.

So called mortgage insurance is life insurance which will pay off the remaining amount due on a home loan on the death of the husband or wife. Life insurance is a form of insurance in which a person makes regular payments to an. Life insurance proceeds are usually not included in the probate of a dead persons estate but the funds may be counted by the internal revenue service in calculating estate tax.

Life insurance is a contract between an insurer and a policyholder in which the insurer guarantees payment of a death benefit to named beneficiaries upon the death of the insured. The policys purpose is to give insurance to. Permanent life insurance policies offer a cash value component that makes them more expensive than term policies and is usually only a good option for people with particular circumstances.

Meaning pronunciation translations and examples log in dictionary. Life insurance definition is insurance providing for payment of a stipulated sum to a designated beneficiary upon death of the insured. What is life insurance.

There is no savings component as found in a whole life insurance product. Life is beautiful but also uncertain. Insurance cover that serves two major purposes.

Life insurance or life assurance especially in the commonwealth of nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money the benefit in exchange for a premium upon the death of an insured person often the policy holder. 1 to substitute for the insureds income if he or she dies and 2 to qualify the insured for favorable tax treatment.

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

Whole Life Insurance Definition What Does Whole Life Insurance

Whole Life Insurance Definition What Does Whole Life Insurance

What Is Term Life Insurance Definition And Insurance Tips

What Is Term Life Insurance Definition And Insurance Tips

Definition Of Health Insurance

Life Insurance Made Simple Policypal

Life Insurance Made Simple Policypal

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Ppt Unique Characteristics Of Life Insurance Powerpoint

Ppt Unique Characteristics Of Life Insurance Powerpoint

Types Of Life Insurance Policy

The Definition Of A Life Insurance Youtube

The Definition Of A Life Insurance Youtube

Fundamaltal Of Life Insurance Docsity

Fundamaltal Of Life Insurance Docsity

How Does Term Life Insurance Work Difinitive Guide 2020

How Does Term Life Insurance Work Difinitive Guide 2020

Articles Junction Types Of Life Insurance Policies Life Insurance

Articles Junction Types Of Life Insurance Policies Life Insurance

Seven Stereotypes About Life Insurance Rider Definition

Seven Stereotypes About Life Insurance Rider Definition

Lecture Twelve Fundamentals And Types Of Life Insurance Ppt

Lecture Twelve Fundamentals And Types Of Life Insurance Ppt

Compare Stepped Vs Level Life Insurance Premiums

Compare Stepped Vs Level Life Insurance Premiums

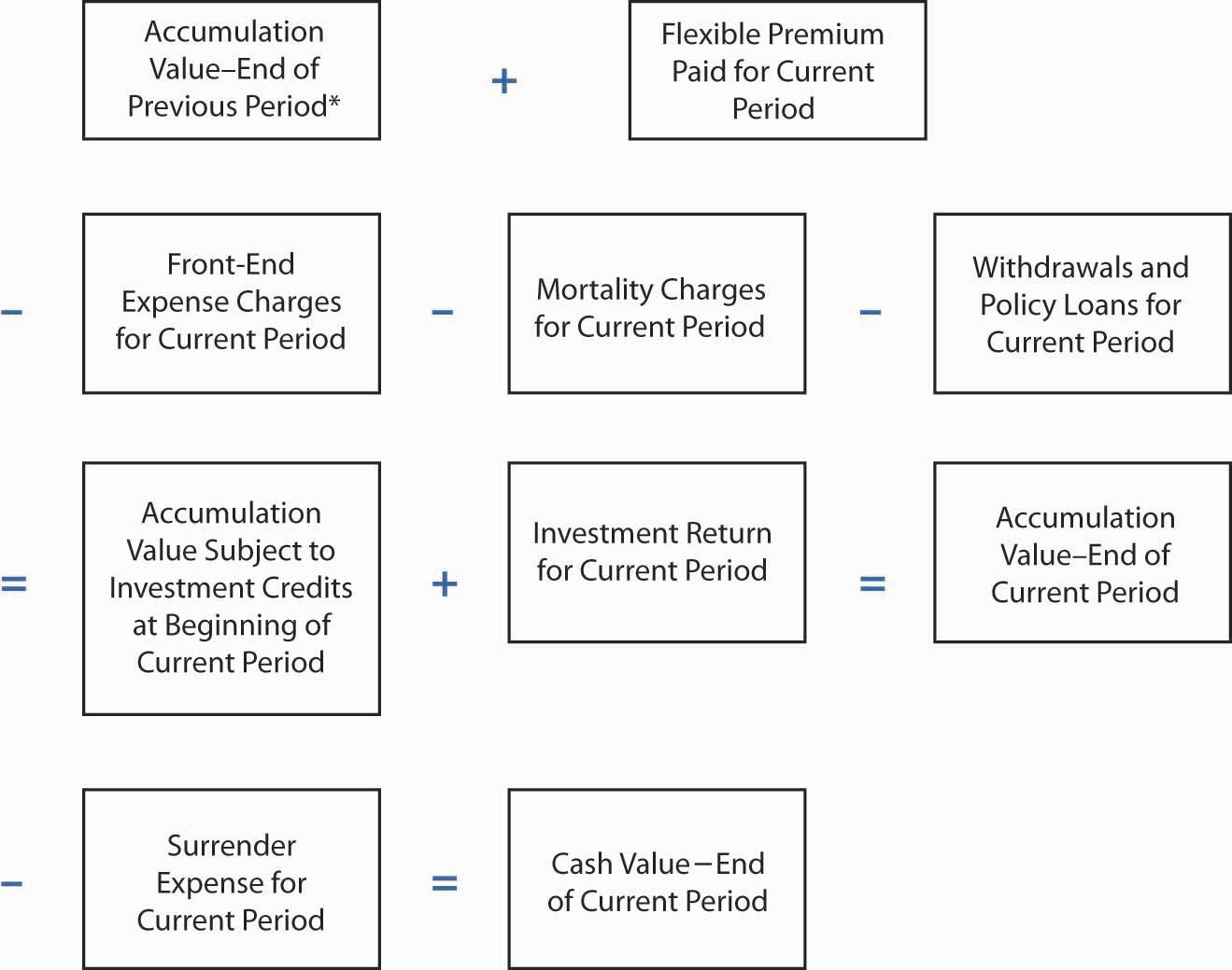

What Is Adjustable Life Insurance Definition By All Finance Terms

What Is Adjustable Life Insurance Definition By All Finance Terms

Is There A Simple Definition Of Life Insurance We Have The Answers

Is There A Simple Definition Of Life Insurance We Have The Answers

Businessinsurance Definition Group Insurance Flood Insurance

Businessinsurance Definition Group Insurance Flood Insurance

Life Insurance Market Conditions And Life Insurance Products

Life Insurance Market Conditions And Life Insurance Products

Correct Spelling For Life Insurance Infographic Spellchecker Net

Correct Spelling For Life Insurance Infographic Spellchecker Net

Post a Comment for "Definition Of Life Insurance"