Deductibility Of Life Insurance Premiums

Generally premiums on insurance policies taken out by an employer on employees are tax deductible if the beneficiaries of those insurance policies are the employees or if the employer has the contractual obligation to pass the payout to the employees or their next of kin. Life insurance policy premiums do not typically qualify as eligible income tax deductions.

1 Business Insurance Part 1 Working With Business Owners Jorge

1 Business Insurance Part 1 Working With Business Owners Jorge

Whether youre an individual or a business owner its essential that you consult a licensed accountant for any tax related questions as they can offer the most accurate advice based on your situation.

Deductibility of life insurance premiums. As an individual when you pay life insurance premiums they are not deductible on your income tax return. Deducting your life insurance premiums as a business expense makes the benefits on the policy become taxable. If you do this with a large group policy beyond the 50000 of coverage available for s corps and llcs this means that all of your employees will get saddled with a tax on their benefits.

Premiums may be deducted in some cases. However a deduction is permitted where an insurance policy is collaterally assigned by the policyholder to secure a loan used by the policyholder to earn income from a business or property. Deductibility of life insurance premiums if you are looking for a reliable and free insurance quote then we can help you immediately with our convenient online service.

You are included among potential beneficiaries. Heres a look at what the canada revenue agency requires. Insurance policy premiums can be expensive depending on these factors and many people would like to deduct this expense from their income tax.

For policies issued before june 9 1997 you cant deduct the premiums on a life insurance policy covering you an employee or any person with a financial interest in your business if you are directly or indirectly named as a beneficiary of the policy. For the most part life insurance premiums are not tax deductible but there are certain situations where they can be. You cant deduct premiums on some life insurance and annuities.

This is on the basis that the premiums paid are a staff continue reading deductibility of life or personal accident. A life or health insurance policy is owned by a shareholder but the premiums are paid by the corporation. Life insurance premiums vary in amount according to the age and health of the insured the face amount of the policy and whether the policy is whole life or term insurance.

Deductible employer paid life insurance premiums. However in certain situations involving employee benefits and other corporate arrangements some of the. Premiums payable under a life insurance policy are generally not deductible for income tax purposes.

This isnt because insurance premiums are by themselves deductible but because the insurance premiums are treated as payments or contributions that are deductible. However if you are a business owner and you pay life insurance premiums on behalf your employees your expenses may be deductible.

Holding Insurance Within Superannuation Money Management

Holding Insurance Within Superannuation Money Management

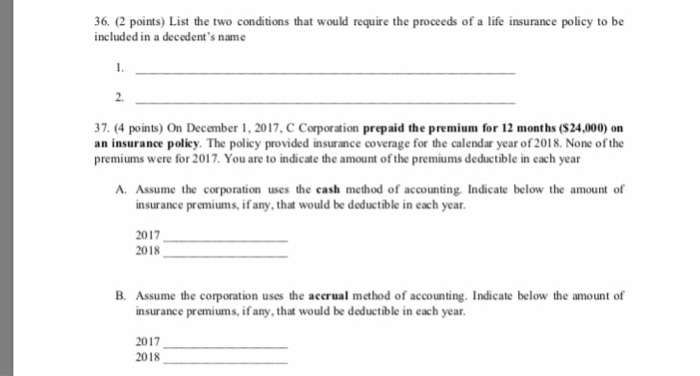

Solved 36 2 Points List The Two Conditions That Would

Solved 36 2 Points List The Two Conditions That Would

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

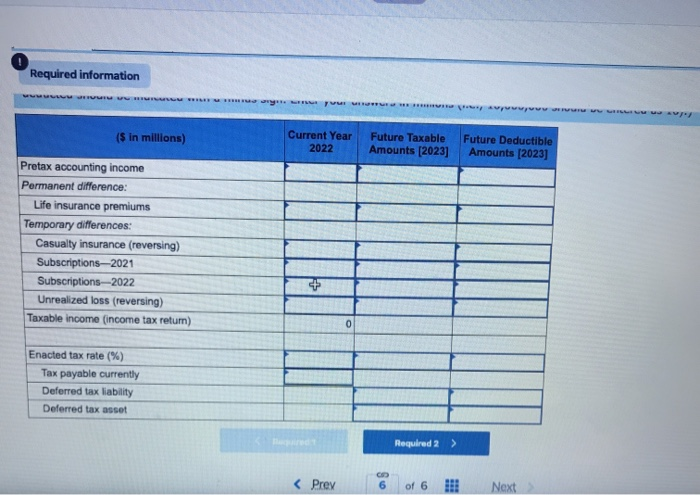

Solved Please Show All Steps And Explain The Correcr Wa

Solved Please Show All Steps And Explain The Correcr Wa

Money Archives True Blue Life Insurance

Money Archives True Blue Life Insurance

Life Insurance Premium Powerpoint Template Slidestore

Life Insurance Premium Powerpoint Template Slidestore

1 3 Consolidation Of Chart Of Accounts Simple Fund 360 Knowledge

1 3 Consolidation Of Chart Of Accounts Simple Fund 360 Knowledge

Life Insurance Policies Life Insurance Policies Deductible

Life Insurance Policies Life Insurance Policies Deductible

Are Life Insurance Premiums Tax Deductible Quotacy

Are Life Insurance Premiums Tax Deductible Quotacy

Life Insurance Tax Deductible Premiums Save Money Chatsworth Cpa

Life Insurance Tax Deductible Premiums Save Money Chatsworth Cpa

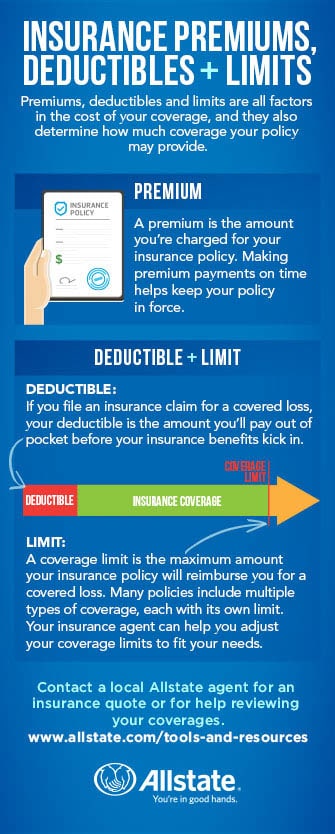

Insurance Premiums Deductibles And Limits Defined Allstate

Insurance Premiums Deductibles And Limits Defined Allstate

Insurance Premiums Deductibles And Limits Defined Allstate

Insurance Premiums Deductibles And Limits Defined Allstate

The State Of The Nation Should Epf Tax Relief Be Reduced Next

The State Of The Nation Should Epf Tax Relief Be Reduced Next

What You Need To Know About Insurance At Tax Time

What You Need To Know About Insurance At Tax Time

Is Life Insurance Tax Deductible For Business Owners Pinoy

Is Life Insurance Tax Deductible For Business Owners Pinoy

Is Life Insurance Taxable Gerber Life Insurance

Is Life Insurance Taxable Gerber Life Insurance

Search Q Whole Life Insurance Cash Value Chart Tbm Isch

Secret Answers To Life Insurance Premium Tips Identified

Secret Answers To Life Insurance Premium Tips Identified

Health Insurance Tax Benefits Under Section 80d

Health Insurance Tax Benefits Under Section 80d

Philippines General Insurance Continued Pdf Free Download

Philippines General Insurance Continued Pdf Free Download

Premium Financing As Tool For Life Insurance Funding

Premium Financing As Tool For Life Insurance Funding

Know Differences Between Tax Deductions On Life And Health

Know Differences Between Tax Deductions On Life And Health

F O O T E R The Manufacturer Life Insurance Company Affinity

F O O T E R The Manufacturer Life Insurance Company Affinity

Post a Comment for "Deductibility Of Life Insurance Premiums"