Decreasing Life Insurance

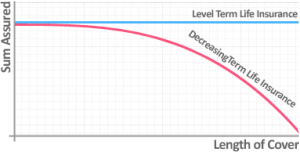

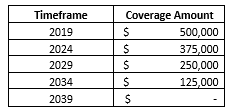

If your decreasing life insurance is to cover your mortgage the policy may not completely pay off your outstanding mortgage unless you make sure your cover amount is adjusted to match any new mortgage arrangements. The idea is that the amount of cover paid out goes down each year for the length of the policy eventually finishing at 0.

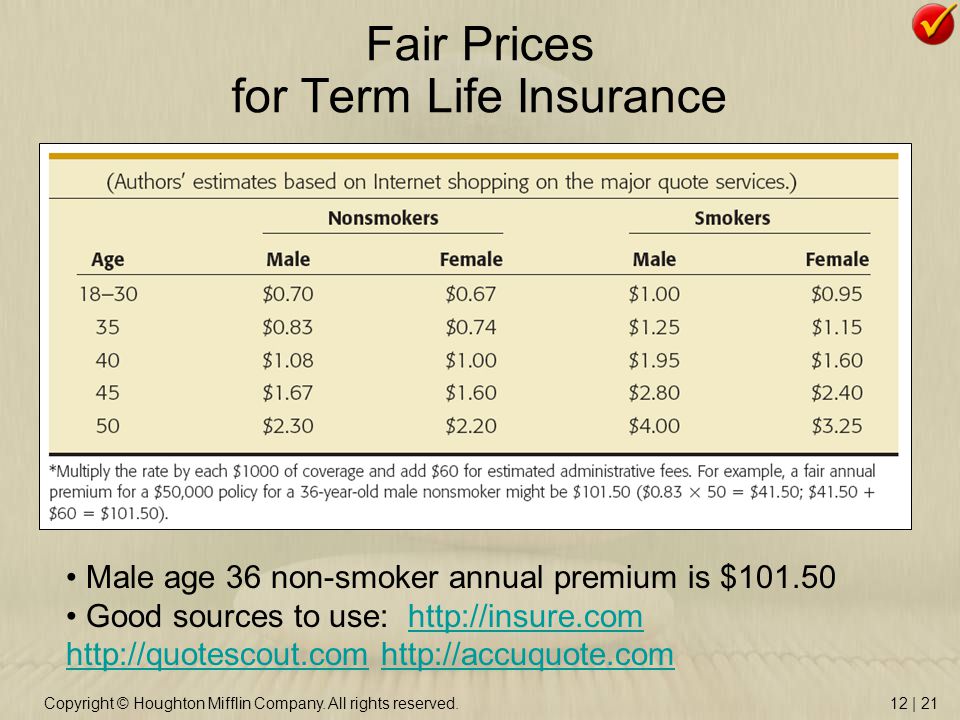

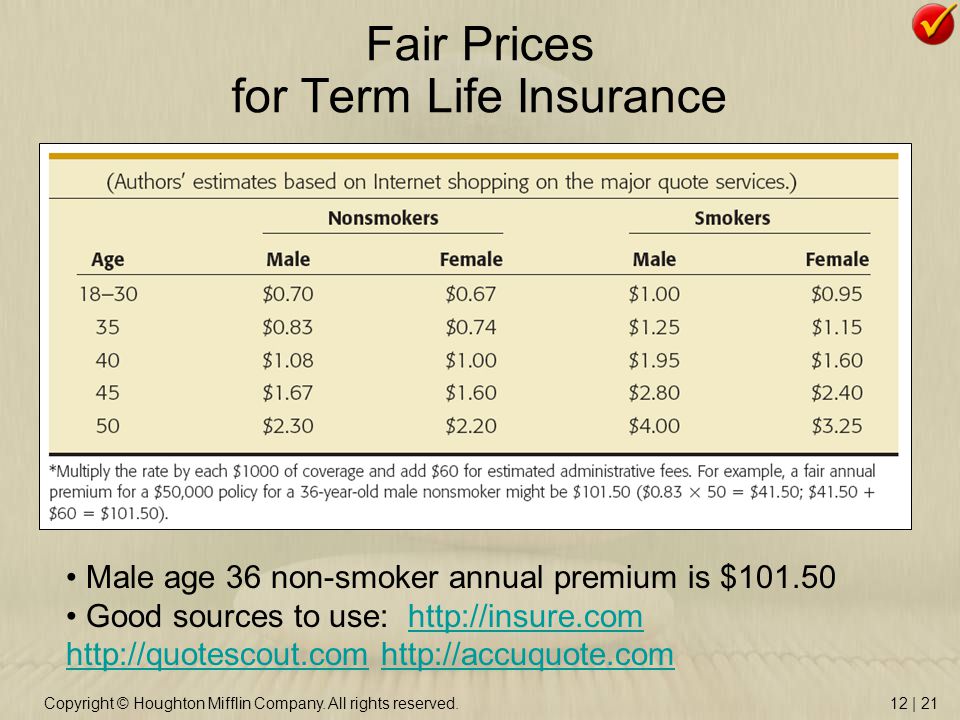

Elegant Decreasing Term Life Insurance Quote Thenestofbooksreview

Elegant Decreasing Term Life Insurance Quote Thenestofbooksreview

It aims to pay out a cash sum that decreases over time if your client dies while covered by the policy.

Decreasing life insurance. Read how decreasing term life insurance can help your family pay off your debts. Normally decreasing term life insurance is taken to enable the policy holders dependents to pay off an outstanding debt that is going down. Decreasing term life cover is designed to help your loved ones pay off your financial commitments such as a repayment mortgage loans or credit card balances if you pass away during the term of the policy.

What is decreasing term life insurance. Decreasing life insurance. Decreasing life insurance if you are looking for low cost insurance then our online insurance quotes service will help you find a provider that works for you.

Its often used to cover the balance of a repayment mortgage because this is a type of loan that also decreases over time. Our life insurance products offer cover up to age 90 with a maximum policy length of up to 50 years. Decreasing term life insurance or simply decreasing life insurance is a type of policy that pays out upon your.

Decreasing term life insurance sometimes known as mortgage decreasing term insurance is bought by homeowners who want to make sure their mortgage will be settled after their death. There are so many that it can often be hard to work out which one is the right one for you. Decreasing life insurance if you are looking for insurance protection you can trust then our insurance quotes service can help you find someone you feel comfortable with.

The level of pay out decreases over the length of the policy. There are several different types of life insurance plans out there. The plan is designed to help protect a repayment mortgage.

Decreasing term insurance is a more affordable option than whole life or universal life insurancethe death benefit is designed to mirror the amortization schedule of a mortgage or other high. Decreasing term life insurance is a type of life insurance policy thats paid over a fixed period of time. Life cover is not a savings or investment product and has no cash value unless a valid claim is made.

Indeed many mortgage lenders stipulate that life insurance must be in place at the outset of your agreement.

Decreasing Term Life Bad Purchase Don T Buy Before Reading This

Decreasing Term Life Bad Purchase Don T Buy Before Reading This

Decreasing Term Life Insurance Infotech Report

Decreasing Term Life Insurance Infotech Report

Decreasing Term Insurance Assurance What Is It

Decreasing Term Insurance Assurance What Is It

75 Decreasing Life Insurance Quotes Malloryheartcozies

75 Decreasing Life Insurance Quotes Malloryheartcozies

Decreasing Term Life Insurance What Are The Pros Cons

Decreasing Term Life Insurance What Are The Pros Cons

Decreasing Term Life Insurance Term Life Term Life Insurance

Decreasing Term Life Insurance Term Life Term Life Insurance

Credit Life Credit Disability Insurance

Credit Life Credit Disability Insurance

The Downside Of Mortgage Life Insurance

The Downside Of Mortgage Life Insurance

:max_bytes(150000):strip_icc()/guaranteed_vs_non_guaranteed_permanent_life_insurance_policies-5bfc375b46e0fb0083c3769b.jpg) Decreasing Term Insurance Definition

Decreasing Term Insurance Definition

Decreasing Term Life Insurance Infotech Report

Decreasing Term Life Insurance Infotech Report

Aa Life Insurance 2020 Review Reassured

Aa Life Insurance 2020 Review Reassured

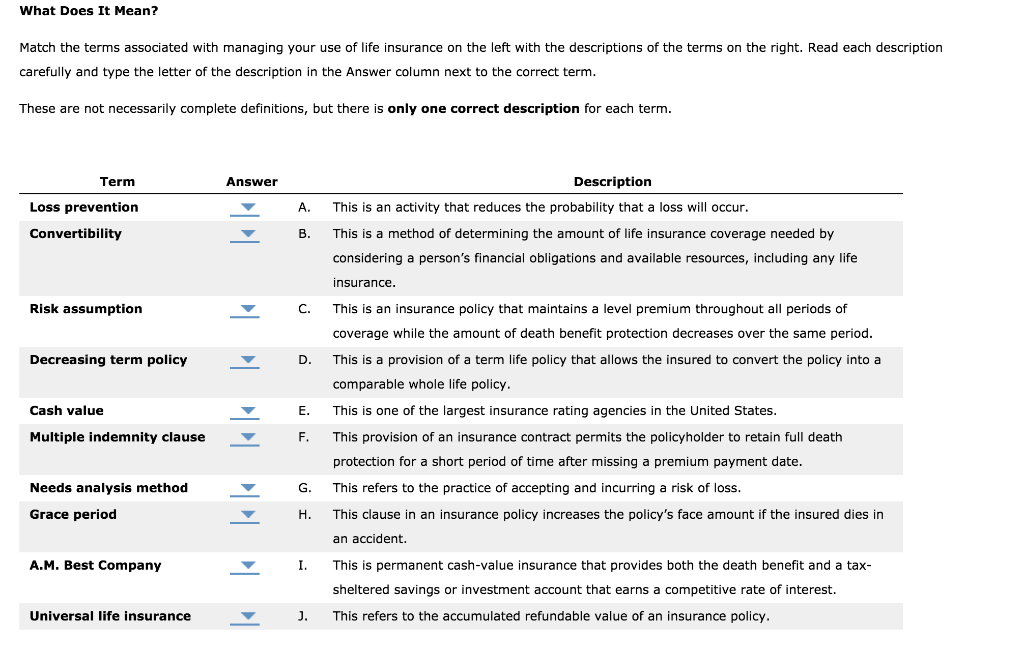

Solved What Does It Mean Match The Terms Associated With

Solved What Does It Mean Match The Terms Associated With

Decreasing Term Life Insurance Decreasing Term Life Insurance

Decreasing Term Life Insurance Decreasing Term Life Insurance

Is Decreasing Term Life Insurance A Good Policy For You

Is Decreasing Term Life Insurance A Good Policy For You

Mortgage Life Insurance Know Before You Buy Compare Rates

Mortgage Life Insurance Know Before You Buy Compare Rates

Ncpers National Conference On Public Employee Retirement Systems

Ncpers National Conference On Public Employee Retirement Systems

Decreasing Term Insurance Explained See Best Alternatives

Decreasing Term Insurance Explained See Best Alternatives

1 Quotes Decreasing Life Insurance Quotes 44billionlater

1 Quotes Decreasing Life Insurance Quotes 44billionlater

Post a Comment for "Decreasing Life Insurance"