Cash Surrender Value Of Term Life Insurance

However there are different types of life insurance some that offer a surrender value known as whole life policies and some that dont called term life insurance policies. Fees are taken from the cash value before you get the pay out.

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

A term insurance policy provides coverage for a fixed number of years such as 10 or 20 years and then the coverage stops.

Cash surrender value of term life insurance. No term life insurance does not have a cash surrender value in most cases. What is cash surrender value. If you arent dead by the end of the term the policy never pays.

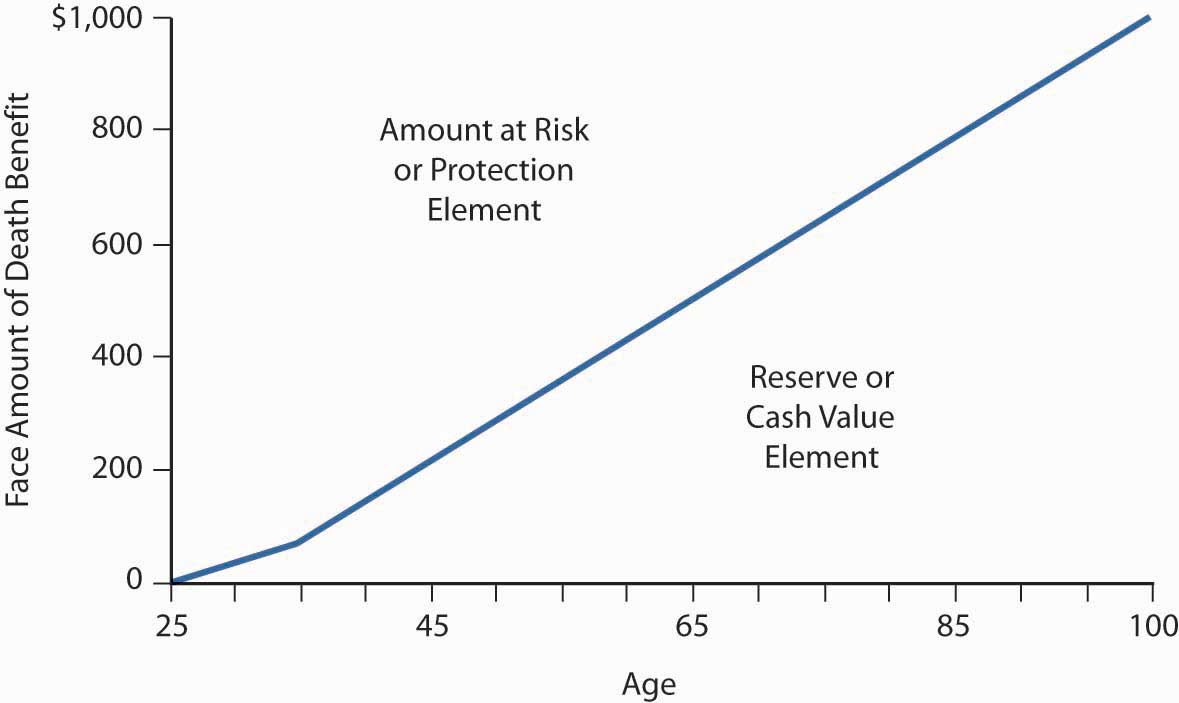

Term insurance has a low cost up front because it does not have a cash value accumulation. Whole life insurance by design is really like a reducing term policy with a cash account that builds guaranteed cash value as you get further and further into the policy years. How much you actually receive from the cash value of your life insurance policy is based on the surrender value which can sometimes be much lower.

Life insurance provides financial security for those you leave behind after your death whether it be paying for school or transferring wealth. If you dont die during the the policy term and the policy term expires or if you cancel the policy there is no refund or surrender value for term life insurance. The cash surrender value in your life insurance policy is essentially the amount of cash that you can withdraw if you surrender your policy to your insurance company and allow it to lapsethis amount can vary according to a variety of factors.

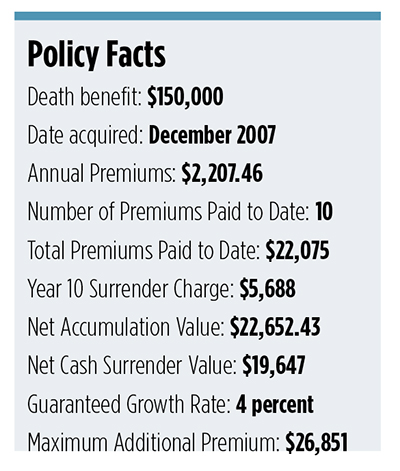

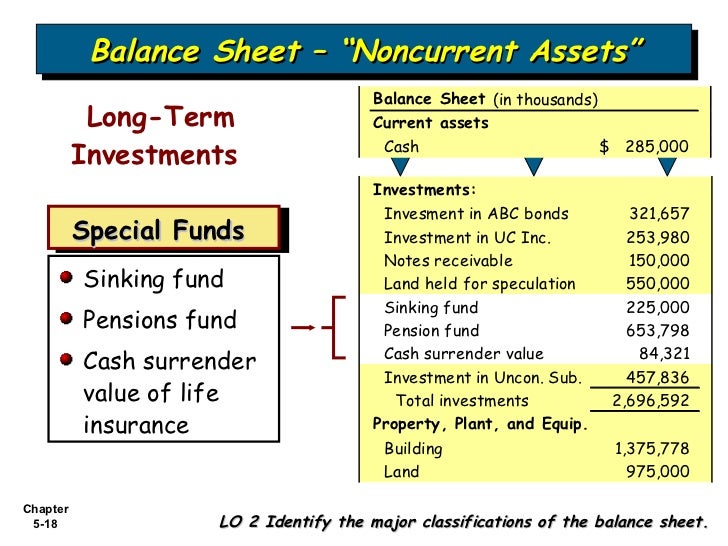

The cash surrender value is the portion of your insurance that you have built up your own money in. However during the early years of a whole life insurance policy the savings portion. When you decide to surrender your life insurance policy you are essentially requesting to cancel the life insurance in exchange for any cash value that has accumulated.

Life insurance comes in two main flavors. Term coverage doesnt typically have a surrender value though with some policies you can at least recover your premiums. When you cash out your policy there may be fees charged by the insurance company.

Permanent insurance term and permanent life insurance represent. What is life insurance cash surrender value. Permanent life insurance also called cash value life insurance is an entire category of life insurance plans that last as long as you pay the premiums and has a cash value component.

Cash surrender value applies to the savings element of whole life insurance policies payable before death. Rop return of premium term costs more than regular term life insurance but does return the premiums paid in at the end of the term if the insured is still alive.

Why Almost Every Life Insurance Policy With Cash Value Stinks

Why Almost Every Life Insurance Policy With Cash Value Stinks

Can I Cash In A Whole Life Insurance Policy Farm Bureau

Can I Cash In A Whole Life Insurance Policy Farm Bureau

What To Know About Cashing Out Life Insurance Harbor Life

What To Know About Cashing Out Life Insurance Harbor Life

How To Calculate Cash Value Of A Life Insurance Quora

New York Life Insurance Company Reviews How To Calculate Cash

New York Life Insurance Company Reviews How To Calculate Cash

What Is Cash Surrender Value Of Life Insurance Insurance

What Is Cash Surrender Value Of Life Insurance Insurance

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Types Of Life Insurance Policies Which Is Right For You Super

Types Of Life Insurance Policies Which Is Right For You Super

No Waste Ul No Lapse Ul Optimized Glenn Daily

No Waste Ul No Lapse Ul Optimized Glenn Daily

Mortality Risk Management Individual Life Insurance Ppt Video

Mortality Risk Management Individual Life Insurance Ppt Video

Term Insurance Vs Whole Life Insurance Policy

Term Insurance Vs Whole Life Insurance Policy

Types Of Life Insurance Financialplanning

Types Of Life Insurance Financialplanning

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Low Cost Life Insurance Cash Surrender Value Of Life Insurance

Low Cost Life Insurance Cash Surrender Value Of Life Insurance

Surrender A Universal Life Insurance Policy Wealth Management

Surrender A Universal Life Insurance Policy Wealth Management

Guide To Purchasing Life Insurance

Guide To Purchasing Life Insurance

What Is Cash Surrender Value In Life Insurance Mason Finance

What Is Cash Surrender Value In Life Insurance Mason Finance

Surrender A Universal Life Insurance Policy Wealth Management

Surrender A Universal Life Insurance Policy Wealth Management

Whole Life Participating Insurance Max Life Insurance

Whole Life Participating Insurance Max Life Insurance

What Is The Cash Value Of Term Life Insurance

What Is The Cash Value Of Term Life Insurance

What Is Whole Life Insurance Explained Definition Benefits

What Is Whole Life Insurance Explained Definition Benefits

New York Life Insurance Company Reviews How To Calculate Cash

New York Life Insurance Company Reviews How To Calculate Cash

Post a Comment for "Cash Surrender Value Of Term Life Insurance"