Cash Value Life Insurance Tax

Cash value life insurance tax if you are looking for insurance that will help you feel protected then our insurance quotes can provide you with options that are right for you. The cash value of a life insurance policy is the amount of money you would receive by surrendering the policy.

Life And Health Insurance Ppt Video Online Download

Life And Health Insurance Ppt Video Online Download

The choice can have a number of financial implications including tax liability.

Cash value life insurance tax. Your whole life or variable life insurance policy could be a source of cash while youre still alive. Types of cash value life insurance policies. Each policy has a.

Most of the time proceeds arent taxable. The insurance company will cancel your policy and mail you a check for your account balance. Here are some factors to consider before.

Cash value life insurance tax if you are looking for multiple quotes on different types of insurance then our insurance quotes service can give you the information you need. The policyholder can use the cash value for many purposes such as a source of loans. If youve built up a sizable cash value you may also choose to take out a loan against your policylife insurance companies often offer these cash value loans at interest rates lower than a.

Cash value life insurance and taxes is a conversation that usually goes hand in hand. So life insurance has often been touted as a no brainer idea for those who dislike the april 15th. You see life insurance and taxes are old friendskind of like how alexander hamilton and aaron burr were old buds.

Whether to cash in a life insurance policy is an important decision. How to calculate taxable income when cashing out life insurance pre death. Cash value life insurance is a form of permanent life insurance that features a cash value savings component.

Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. But there are certain. Tax implications for the cash surrender of life insurance if your life insurance policy has cash value you can take out your money whenever you want through a cash surrender.

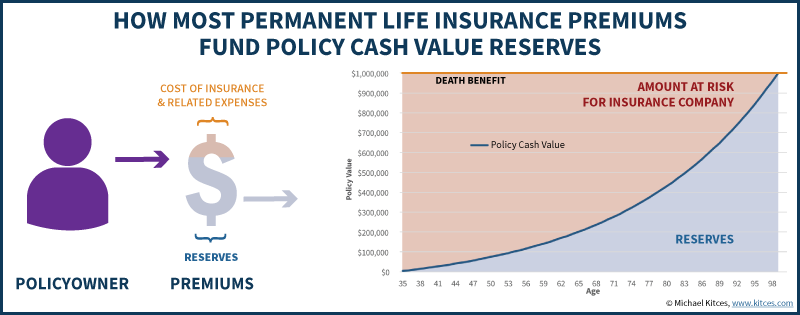

The cash value serves as an investment that accumulates tax deferred interest. Any cash value that remains in the life insurance policy when you die is kept by the insurer.

The Hidden Value In Whole Life Insurance Employee Benefit Adviser

The Hidden Value In Whole Life Insurance Employee Benefit Adviser

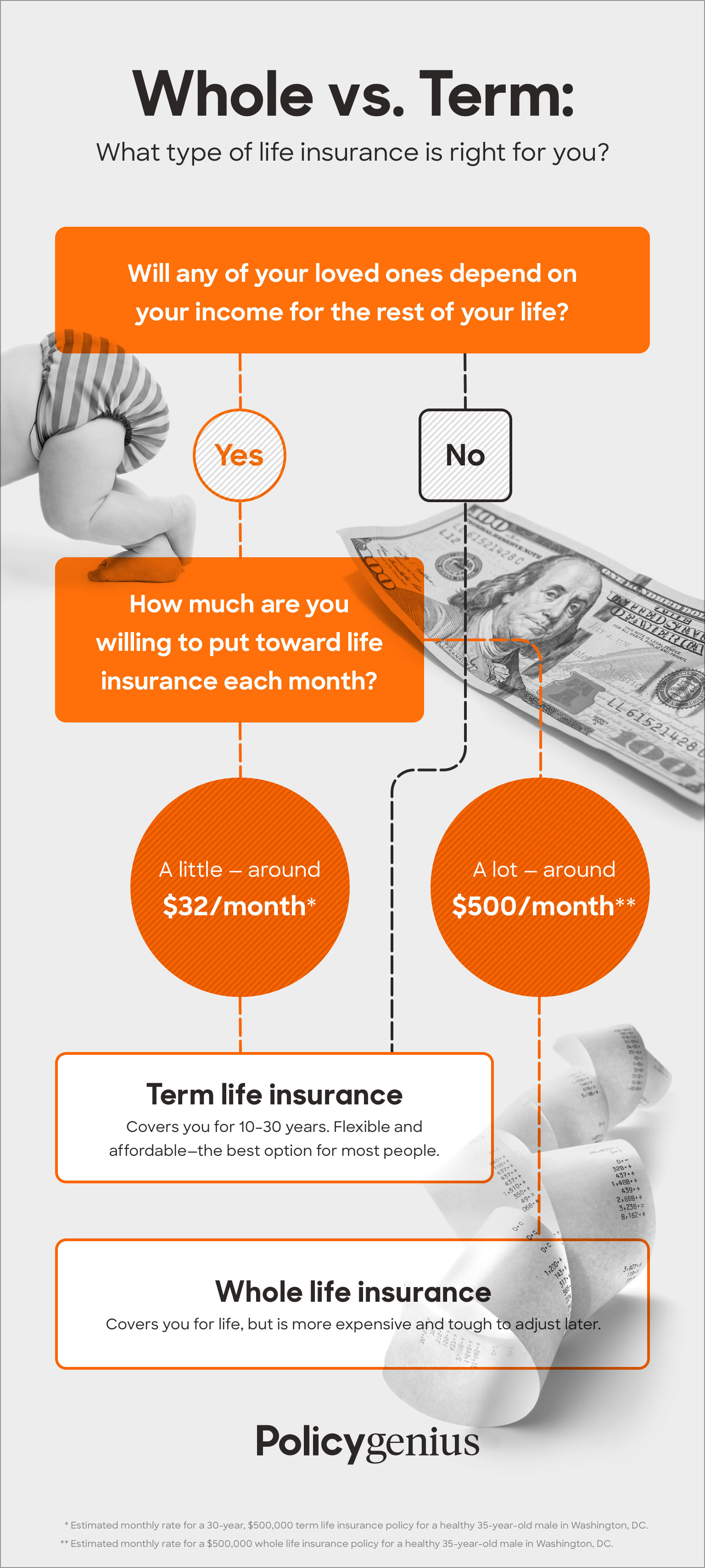

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

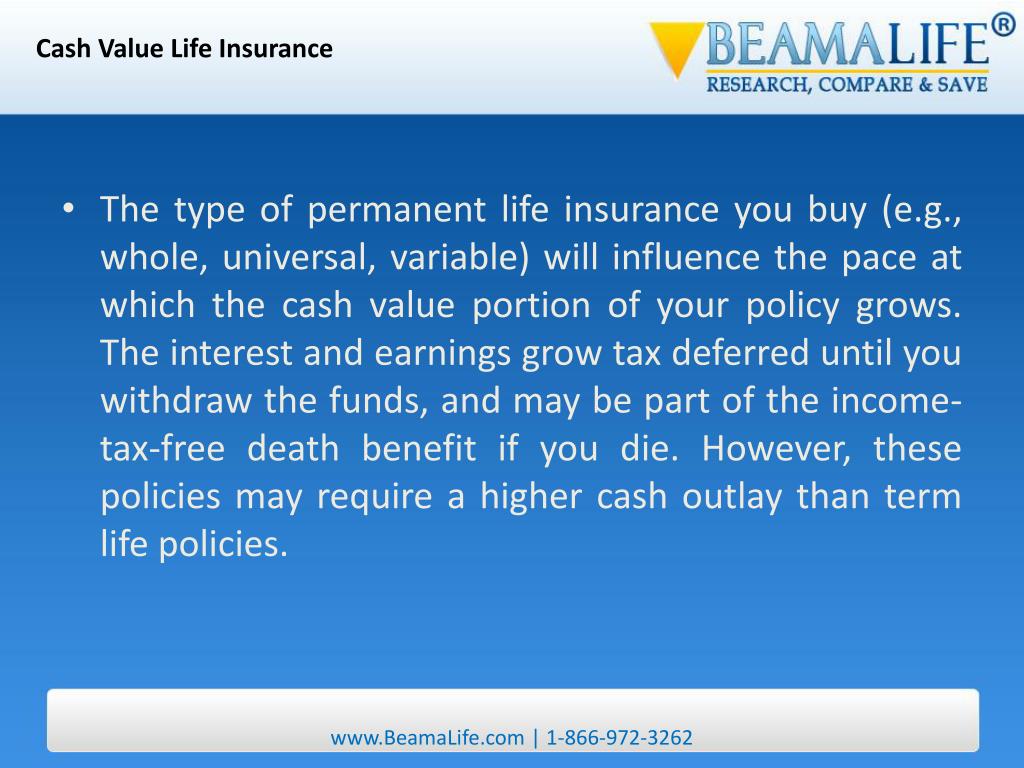

Ppt Cash Value Life Insurance Powerpoint Presentation Free

Ppt Cash Value Life Insurance Powerpoint Presentation Free

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Universal Life Insurance Get More Than Whole Life Sfg

Universal Life Insurance Get More Than Whole Life Sfg

The Role Of Life Insurance In Retirement Planning

The Role Of Life Insurance In Retirement Planning

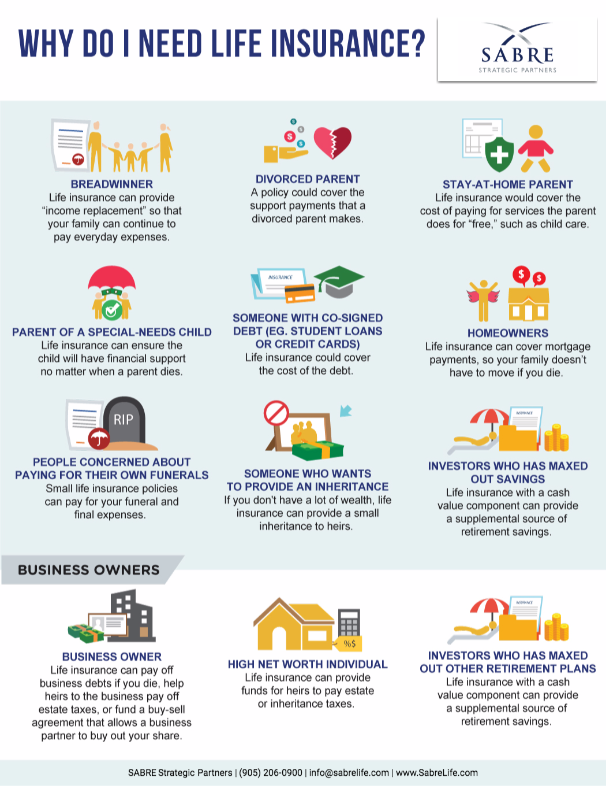

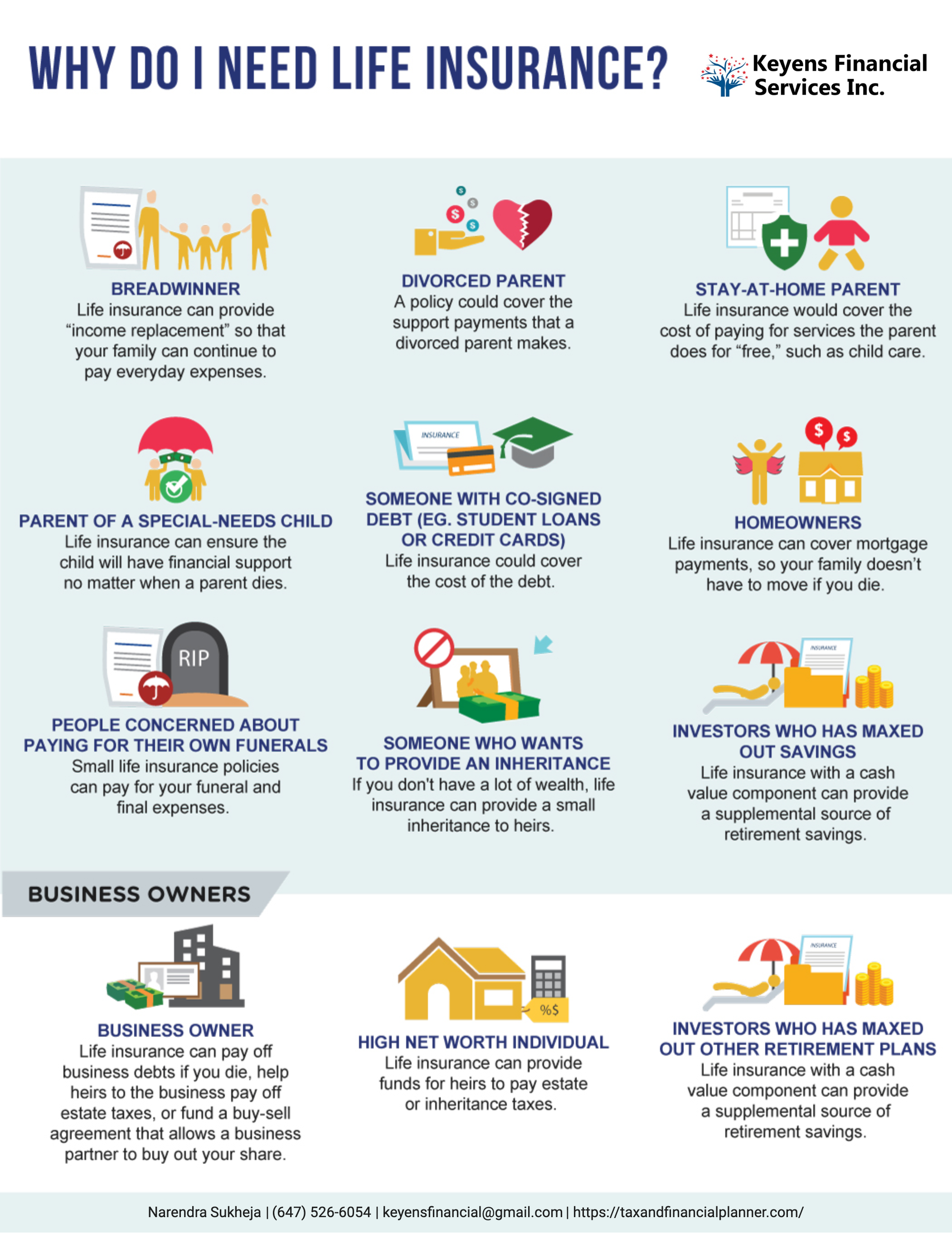

Do You Really Need Life Insurance Sabre Strategic Partners

Do You Really Need Life Insurance Sabre Strategic Partners

Faqs One Million Life Insurance With Half Million Guaranteed

Faqs One Million Life Insurance With Half Million Guaranteed

Do You Really Need Life Insurance Keyens Financial Services Inc

Do You Really Need Life Insurance Keyens Financial Services Inc

Universal Life Insurance Definition

Universal Life Insurance Definition

Taxes On Life Insurance Death Benefits Other

Taxes On Life Insurance Death Benefits Other

Financial Planner Strategies To Reduce Volatility And Improve Tax

Financial Planner Strategies To Reduce Volatility And Improve Tax

Journal Bringing Real Clarity And Understanding Of Cash Value Life

Journal Bringing Real Clarity And Understanding Of Cash Value Life

7702 Plan 770 702j Accounts Explained

7702 Plan 770 702j Accounts Explained

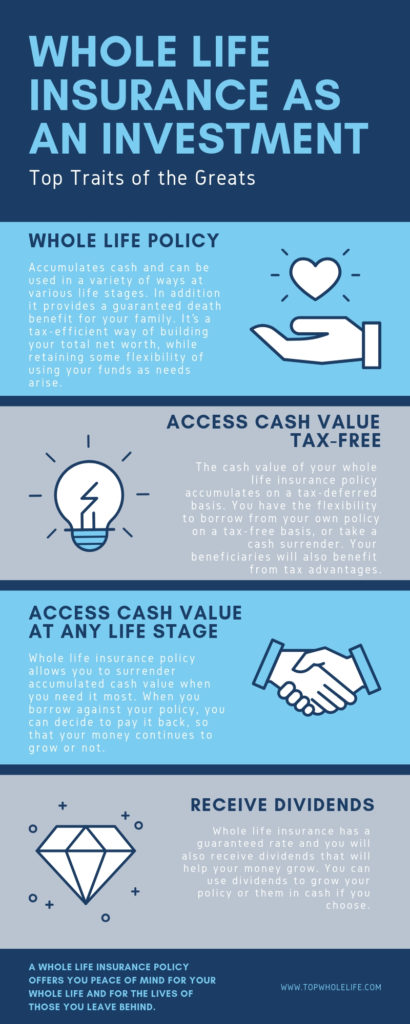

Whole Life Insurance As An Investment Better Returns Than The Bank

Whole Life Insurance As An Investment Better Returns Than The Bank

Journal Investigating The Role Of Whole Life Insurance In A

Journal Investigating The Role Of Whole Life Insurance In A

How To Design Universal Life Insurance To Accumulate Wealth

How To Design Universal Life Insurance To Accumulate Wealth

Types Of Life Insurance Term Ppt Download

Types Of Life Insurance Term Ppt Download

Solved 11 The Cash Value In A Whole Life Insurance Polic

Solved 11 The Cash Value In A Whole Life Insurance Polic

Creating Your Own Private Bank Wealthy Without Wall Street

Creating Your Own Private Bank Wealthy Without Wall Street

White Paper Using Cash Value Life Insurance For Retirement

White Paper Using Cash Value Life Insurance For Retirement

Term Life Insurance The Second Important Feature Most People

Term Life Insurance The Second Important Feature Most People

Post a Comment for "Cash Value Life Insurance Tax"