Cost Of Term Life Insurance By Age

Life insurance companies use many factors to determine your premiums. Age at purchase policy amount 20 year term life 30 year term life.

Term Life Insurance How It Works

Term Life Insurance How It Works

The average cost of term life insurance.

Cost of term life insurance by age. Most insurance agencies arent willing to show sample quotes. By age 55 you could be paying as much as 200 or more per month to get the same coverage you couldve gotten when you were in your 20s. We started our evaluation by showing the change in average life insurance rates for different age groups.

Life insurance policies come in a variety of forms depending on the product that is needed by specific individuals. Lots of people put off getting life insurance due to cost but protecting your assets doesnt have to turn your pockets out. Get your free quote now.

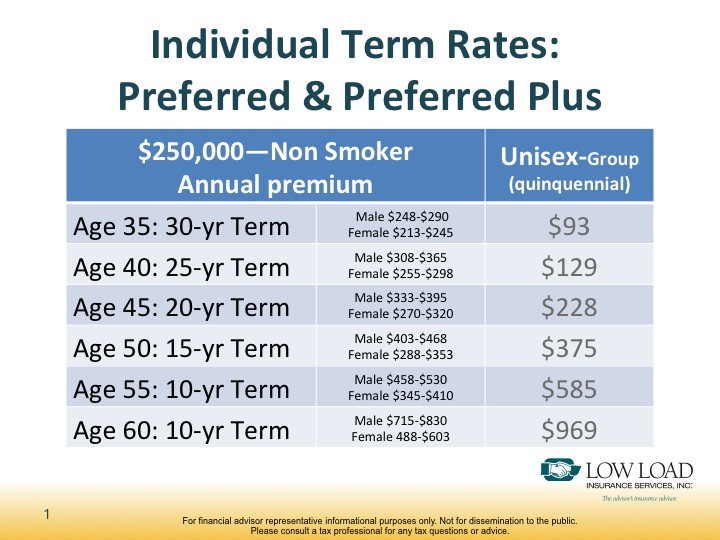

A ten year term being the cheapest policy and a 30 year policy being the most expensive plan. Actual life insurance rates by age. With this post today i have put several term life insurance quotes by age below which will give you a quick estimate of what the cost will be based on life insurance with a medical exam and life insurance with no physical exam.

A 30 year term life insurance policy you buy when youre 25 will cost you a little less than the same plan if bought at age 30 and the premiums just get more expensive from there. Rates will continue to increase as you age due to a decrease in your total life expectancy. One type of life insurance is a term life policy.

Of course this cost varies significantly depending on where you fall on that age spectrum as well as your lifestyle and overall health. We will also cover rates based on age coverage amounts and term length. Whats the average cost of life insurance.

A healthy person aged between 18 and 70 can expect to pay an average of 6788 a month for a 250000 life insurance policy. Term life insurance rates will vary based on age rate class tobacco use gender state and term length. Heres what you need to know.

December 30 2019. But weve decided to buck the trend and give you what you want sample life insurance rates by age with no questions asked. How life insurance rates are determined.

Term permanent and no exam. Average term life insurance rates by age. 500000 term life policy will cost about 100 more per year.

See average life insurance rates for 2020 for healthy. You dont need life insurance rate charts just use the tools below. If youre considering getting a life insurance policy you may be curious to find the average cost of life insurance by age as well as how life insurance rates are determined.

Best life insurance rates by age. Life insurance companies will use age as a determinant for life insurance premiums. This type of policy is offered in a variety of lengths that can range from 10 years up to 30 years.

Two thirds of americans overestimate life insurance rates by hundreds of dollars or more.

Life Insurance Rates Average Policy Cost For 2020

Life Insurance Rates Average Policy Cost For 2020

Is Life Insurance For Children A Waste Of Money

Is Life Insurance For Children A Waste Of Money

What S The Cost Of Term Life Insurance 2020 Monthly Rates

What S The Cost Of Term Life Insurance 2020 Monthly Rates

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

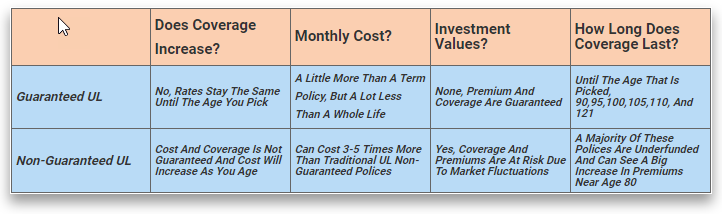

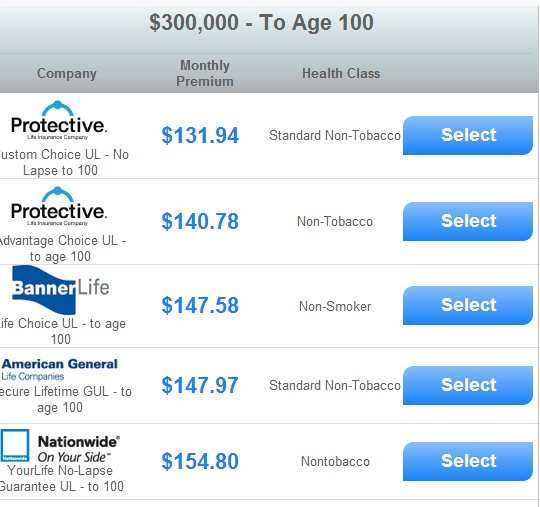

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

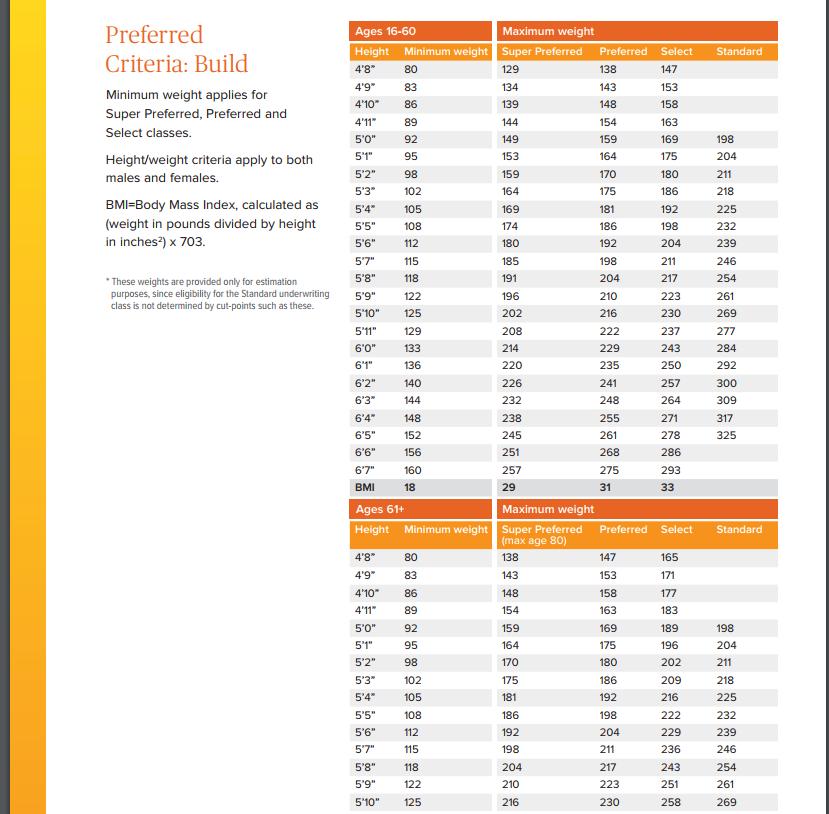

Transamerica Life Insurance Review Policies Pricing

Transamerica Life Insurance Review Policies Pricing

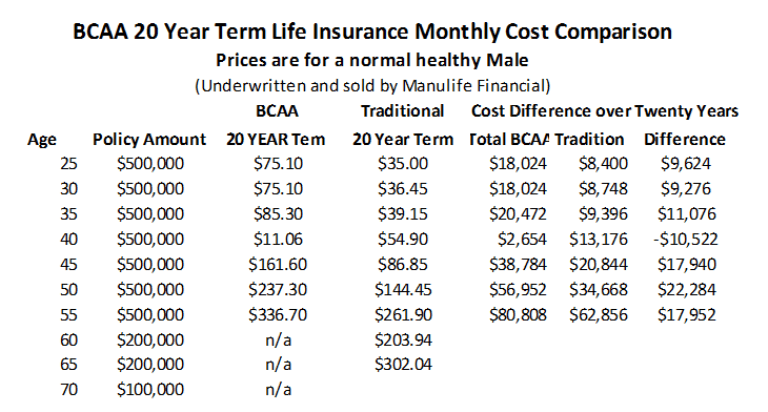

Should You Buy Bcaa Life Insurance Canada Life Insurance Quotes

Should You Buy Bcaa Life Insurance Canada Life Insurance Quotes

Insurance Rates By Age Chart Parta Innovations2019 Org

Insurance Rates By Age Chart Parta Innovations2019 Org

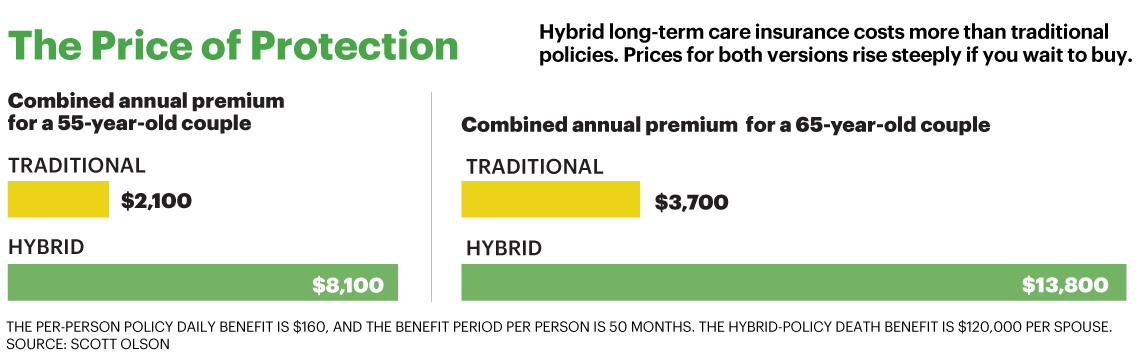

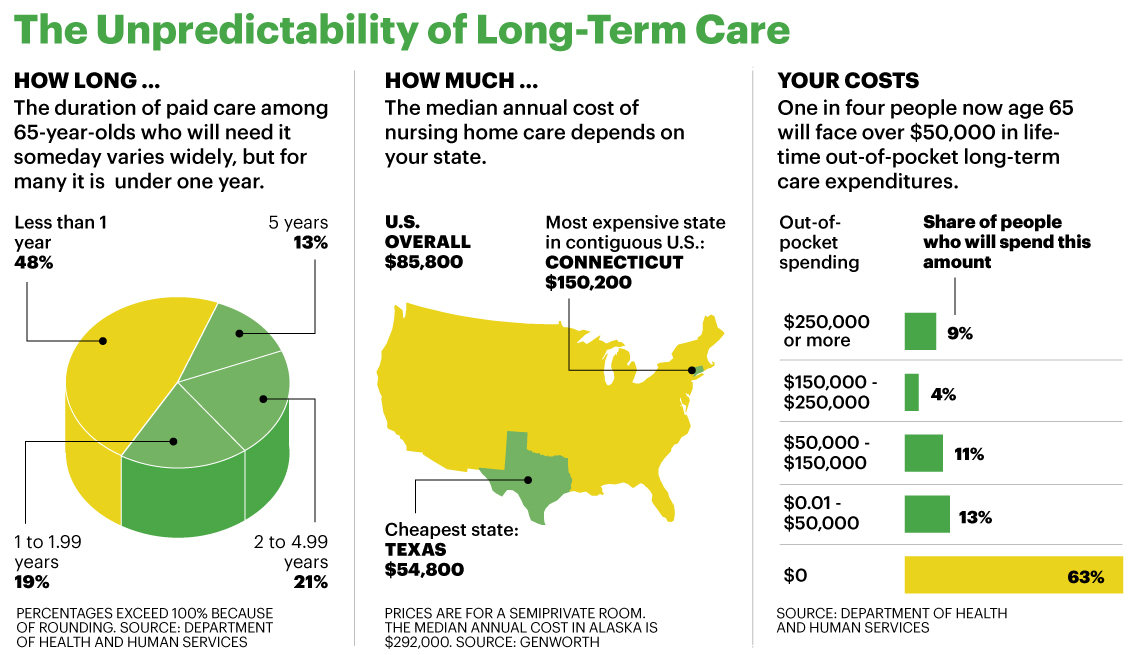

5 Facts You Should Know About Long Term Care Insurance

5 Facts You Should Know About Long Term Care Insurance

Whole Life Insurance How It Works

Term Life Vs Universal Life Insurance

Term Life Vs Universal Life Insurance

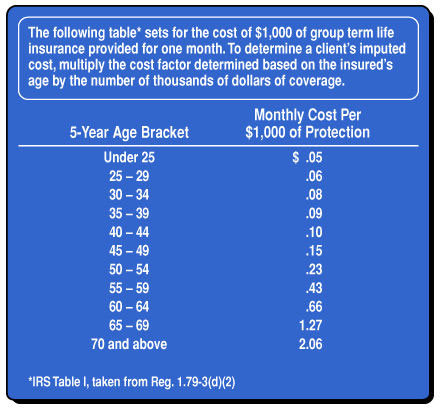

Comparing Group And Individual Term Life Insurance Oliver

Comparing Group And Individual Term Life Insurance Oliver

Typical Term Life Insurance Rates How Much Does Life Insurance Cost

Typical Term Life Insurance Rates How Much Does Life Insurance Cost

Luxury Term Life Insurance Quotes For Seniors Thenestofbooksreview

Luxury Term Life Insurance Quotes For Seniors Thenestofbooksreview

Term Life Insurance For Alberta School Board Employees

Term Life Insurance For Alberta School Board Employees

Whole Life Insurance Policy Whole Life Insurance Quotes

Whole Life Insurance Policy Whole Life Insurance Quotes

5 Facts You Should Know About Long Term Care Insurance

5 Facts You Should Know About Long Term Care Insurance

Investment Moats Page 4 Wealth Mentor For Financial Independence

Investment Moats Page 4 Wealth Mentor For Financial Independence

Post a Comment for "Cost Of Term Life Insurance By Age"