Cashing Out A Whole Life Insurance Policy

If you end up short on cash and are having a difficult time continuing to pay your whole life insurance premium you may be able to stop paying the premium out of pocket and instead use the cash value of your policy to cover the premium. Cashing in your whole life insurance policy is a big decision that can have lasting consequences on your financial lifea whole life insurance policy grows cash value as you get older and as you pay your premiums.

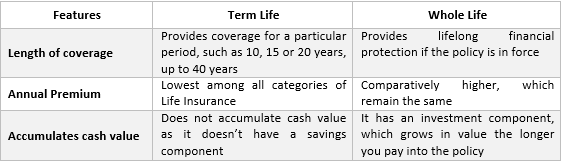

Term Insurance Vs Whole Life Insurance What Is Insurance How

Term Insurance Vs Whole Life Insurance What Is Insurance How

They can help you understand how doing so may affect your financial future.

Cashing out a whole life insurance policy. Cash value life insurance policies such as. When you cash out a life insurance policy your coverage effectively ends meaning that your spouse andor children will no longer be entitled to any death benefit associated with the policy. If you want your whole life insurance policy will last until you die.

Surrendering the policy for the cash value means that the policy will be canceled immediately upon cashing out. For each the following factors should be taken into account before cashing out. Some people think that once the kids have completed college or you have paid off your mortgage it is time to cancel or reduce life insurance.

My policy is about 190000. The best ways to cash out a life insurance policy are to leverage cash value withdrawals take out a loan against your policy surrender your policy or sell your policy in a life settlement or viatical settlement. A whole life insurance policy can provide you with several options.

There are three options available when deciding to cash out or cash in a whole life policy. My parents took out a traditional whole life insurance policy out in 1976 in my name. Can i cash in a life insurance policy.

Were here to help. We have no children. I am currently 58 years old and cashed in the traditional insurance policy to help my son buy a house.

If you are out of options and must access your life insurance policy its better to withdraw or borrow cash versus surrendering the policy altogether. Before you decide to sell your life insurance policy for cash if you need to get cash out of your life insurance policy seek the advice of a life settlement broker financial expert and a tax professional. The cashing out options.

Baby boomers are living longer and cashing out life. My question is about whole life insurancemy wife and i both have policies. If you have multiple life insurance policies cashing out one of them may not have a significant impact on your familys financial well being.

Her cash surrender value with paid up additions is around 200000. Yes cashing out life insurance is possible.

Cashing In Your Life Insurance Policy

Cashing In Your Life Insurance Policy

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

Type Of Life Insurance Policy Should You Get

Type Of Life Insurance Policy Should You Get

Single Premium Whole Life The Pros And Cons Of A Mec

Single Premium Whole Life The Pros And Cons Of A Mec

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

Search Q Whole Life Insurance Graph Tbm Isch

A Look At Whole Life Insurance Financial Directions

A Look At Whole Life Insurance Financial Directions

Life Insurance Term Versus Whole Waepa

Life Insurance Term Versus Whole Waepa

How Much Does Whole Life Insurance Cost Effortless Insurance

How Much Does Whole Life Insurance Cost Effortless Insurance

Don T Be Confused Here S The Gist Of Term Vs Whole Life

Don T Be Confused Here S The Gist Of Term Vs Whole Life

Solved Suppose You Are A Life Insurance Broker With A Cli

Solved Suppose You Are A Life Insurance Broker With A Cli

Northwestern 65 Life Keep It Or Dump It Bogleheads Org

Northwestern 65 Life Keep It Or Dump It Bogleheads Org

Is Whole Life Insurance Right For You Consumer Reports

Is Whole Life Insurance Right For You Consumer Reports

Cashing Out Life Insurance Policy 4 Ways To Cash In Mason Finance

Cashing Out Life Insurance Policy 4 Ways To Cash In Mason Finance

What Is The Difference Between Term Life And Whole Life Policy

What Is The Difference Between Term Life And Whole Life Policy

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

Cashing Life Death Out Insurance Before

Cashing Life Death Out Insurance Before

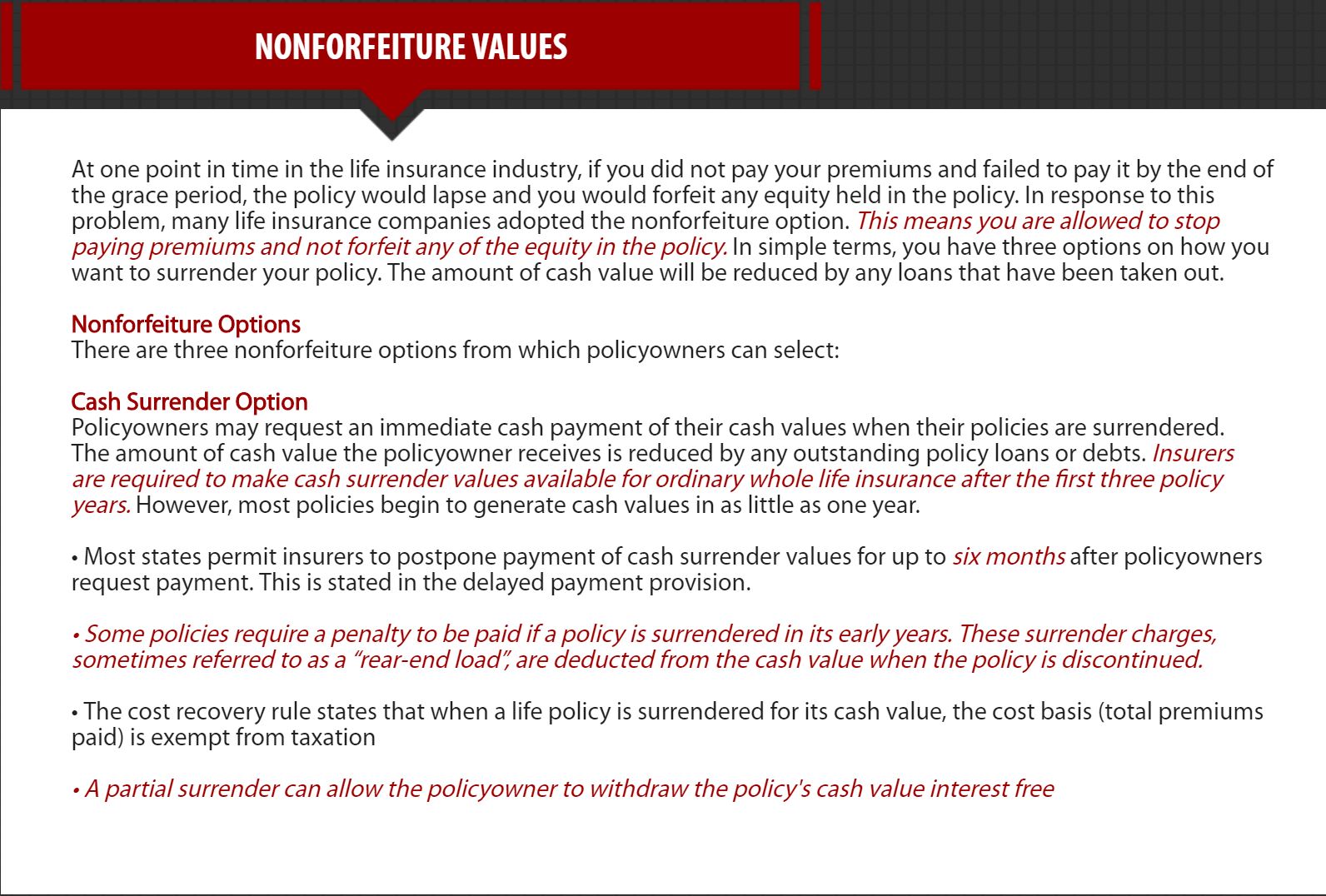

Chapter4 Life Insurance Policies Provisions Options And Riders

Chapter4 Life Insurance Policies Provisions Options And Riders

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Whole Life Insurance Tips Before Deciding Of Life Insurance Policy

Whole Life Insurance Tips Before Deciding Of Life Insurance Policy

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

I Am 80 My Whole Life Insurance Policy Has A Surrender Value Of

Post a Comment for "Cashing Out A Whole Life Insurance Policy"