Cashing In Life Insurance Policies

Cash value life insurance policies can provide you with money at a time when you need it. If you have multiple life insurance policies cashing out one of them may not have a significant impact on your familys financial well being.

Universal Life Insurance Definition

Universal Life Insurance Definition

Take out a loan.

Cashing in life insurance policies. Cashing in life insurance policies if you are looking for the best deals on insurance then our insurance quotes service can provide you with a wide range of options. Walt disney ray kroc and james cash penney all famously cashed out life insurance policies to start their companies or to keep them afloat during tough times. Cash value life insurance policies such as whole life or universal life include a cash accumulation account within the policy.

Yes cashing out life insurance is possible. When you cash out a life insurance policy your coverage effectively ends meaning that your spouse andor children will no longer be entitled to any death benefit associated with the policy. If you want your whole life insurance policy will last until you die.

If you own one of these policies usually called permanent whole or universal life insurance you can cash it out in a relatively simple process. Can i cash in a life insurance policy. Youve got three available options for cashing in on most whole life insurance policies.

The best ways to cash out a life insurance policy are to leverage cash value withdrawals. Cashing in your whole life insurance policy is a big decision that can have lasting consequences on your financial lifea whole life insurance policy grows cash value as you get older and as you pay your premiums. Cashing in life insurance policies if you are looking for the best insurance then our insurance quotes service can give you options to find a plan you are happy with.

Cashing in your life insurance. Many life insurance policies will provide the option of exchanging your policy for either a long term care insurance one one that includes some long term care coverage or an income annuity that makes it possible to avoid paying taxes on your gains. Some people think that once the kids have completed college or you have paid off your mortgage it is time to cancel or reduce life insurance.

Cashing your policy in isnt your only option if you want cash now. Borrowing against the cash value surrendering your policy for the cash value or withdrawing a portion. Baby boomers are living longer and cashing out life.

Life Insurance For Children A Look At The 3 Best Policies

Life Insurance For Children A Look At The 3 Best Policies

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Loans A Risky Way To Bank On Yourself

Cash Value Life Insurance Top 5 Companies And Benefits

Cash Value Life Insurance Top 5 Companies And Benefits

How To Calculate The Cash Surrender Value

How To Calculate The Cash Surrender Value

Cashing In Your Life Insurance Policy

Cashing In Your Life Insurance Policy

Is It Simple To Find Cheap Term Life Insurance

Is It Simple To Find Cheap Term Life Insurance

Can I Cash In My Life Insurance Policy Senior Resources

Can I Cash In My Life Insurance Policy Senior Resources

What To Know About Cashing Out Life Insurance Harbor Life

What To Know About Cashing Out Life Insurance Harbor Life

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

![]() Q Is There Any Compelling Reason Why We Should Retain Our

Q Is There Any Compelling Reason Why We Should Retain Our

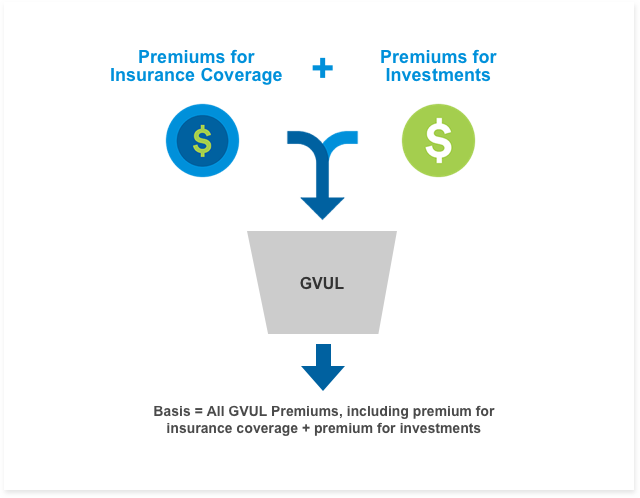

Life Insurance Overview Group Variable Universal Life Metlife

Life Insurance Overview Group Variable Universal Life Metlife

What To Know About Cashing Out Life Insurance Harbor Life

What To Know About Cashing Out Life Insurance Harbor Life

Can I Cash In A Whole Life Insurance Policy Farm Bureau

Can I Cash In A Whole Life Insurance Policy Farm Bureau

5 Steps Before Cashing Out Your Life Insurance Policy Get More Money

5 Steps Before Cashing Out Your Life Insurance Policy Get More Money

Cashing Out A Life Insurance Policy

Cashing Out A Life Insurance Policy

How Do Cash Value Life Insurance Policies Work

How Do Cash Value Life Insurance Policies Work

Your Full Guide To Viatical Settlements Explained Mason Finance

Your Full Guide To Viatical Settlements Explained Mason Finance

Post a Comment for "Cashing In Life Insurance Policies"