Compare Insurance Life Term

That may be for example until your kids have left home or finished their education and the mortgage is paid off. Life insurance can offer the security that your loved ones will be looked after financially if you die but most people only need it for a set period of time.

Compare cheap life insurance quotes at compare the market we make comparing life insurance as simple as possible.

Compare insurance life term. Compare insurance life term if you are looking for the best insurance quotes then our free online service will give you the information you need in no time. That way you can save money and time. With this policy the premium and death benefit rise every year.

Term insurance is a life insurance plan offered by an insurance company that provides comprehensive financial coverage against premiums paid for a limited period to the beneficiary of the policy. We can help you find a plan that will fit your budget. The average monthly cost of life insurance is 1456 according to moneysupermarket data.

If thats the case then a term life insurance policy also known as term assurance could be right for you. Increasing term life insurance. Annual renewable term art life insurance.

A level term policy might be useful for paying off the outstanding capital on an interest only mortgage bills or other debts. Compare insurance life term if you are looking for multiple quotes on different types of insurance then our insurance quotes service can give you the information you need. The cost of life insurance can depend on the type of cover you choose single or joint life insurance and the term of the policy level or decreasing termyour monthly payments will also depend on the amount of cover you take out and your health and lifestyle.

Level term gives you a fixed amount of cover for as long as the policy is in place. With just a few details well find you the cheapest quote from our selected insurance providers. Under term insurance the nominee will receive the life cover amount as a lump sum or monthly income as per the option chosen at the inception of the policy.

Increasing term life insurance is usually sold as a supplement to permanent policies. This coverage provided under term insurance plans is paid as death benefit upon the demise of insured during the policy term. Term insurance is the cheapest form of insurance that offers the pure life cover.

Compare insurance life term if you are looking for the best prices on insurance then youve come to the right place. The two types of term life insurance are level term and decreasing term. This is a one year policy that your provider guarantees to renew every year for a set number of years.

Compare Term Insurance Plans Offered By Hdfc Life Hdfc Life

Compare Term Insurance Plans Offered By Hdfc Life Hdfc Life

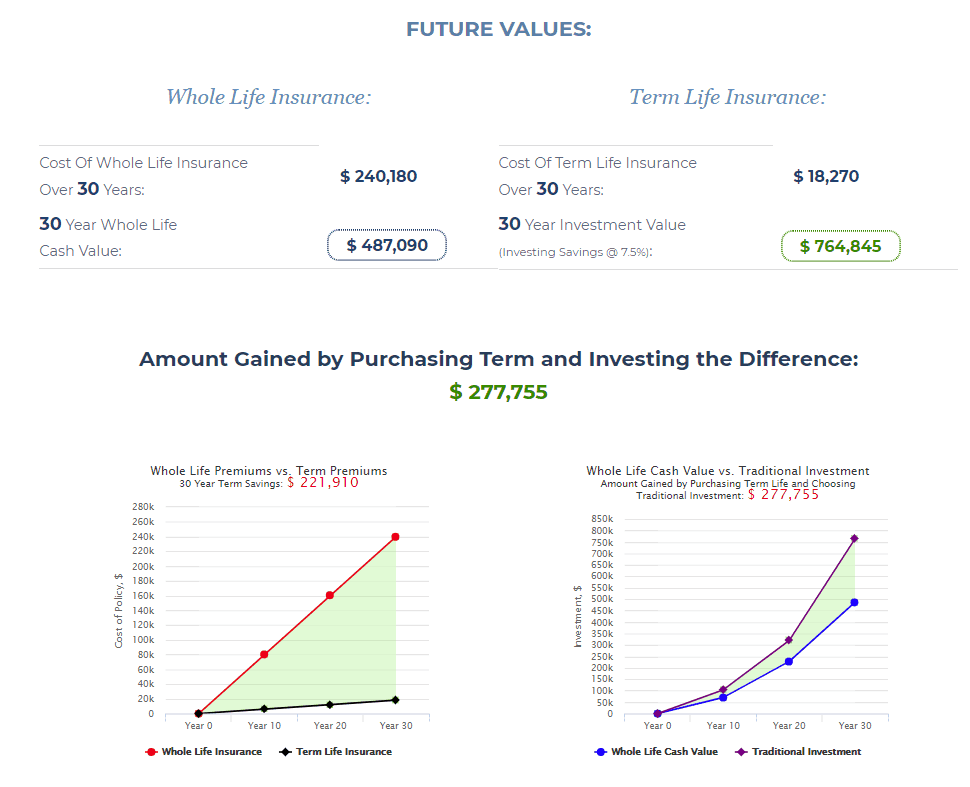

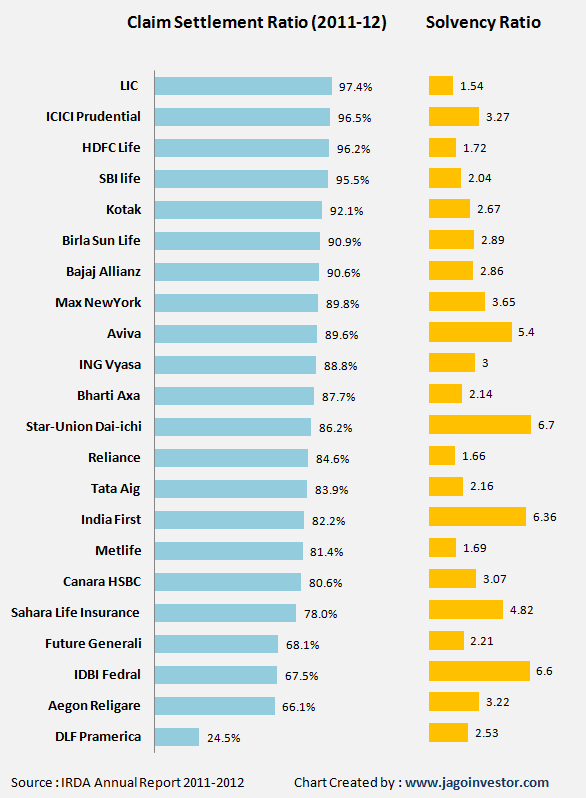

Comparison Between Term Plan And Whole Life Plan Value Investing

Comparison Between Term Plan And Whole Life Plan Value Investing

Difference Between Whole Life And Term Life Insurance With

Difference Between Whole Life And Term Life Insurance With

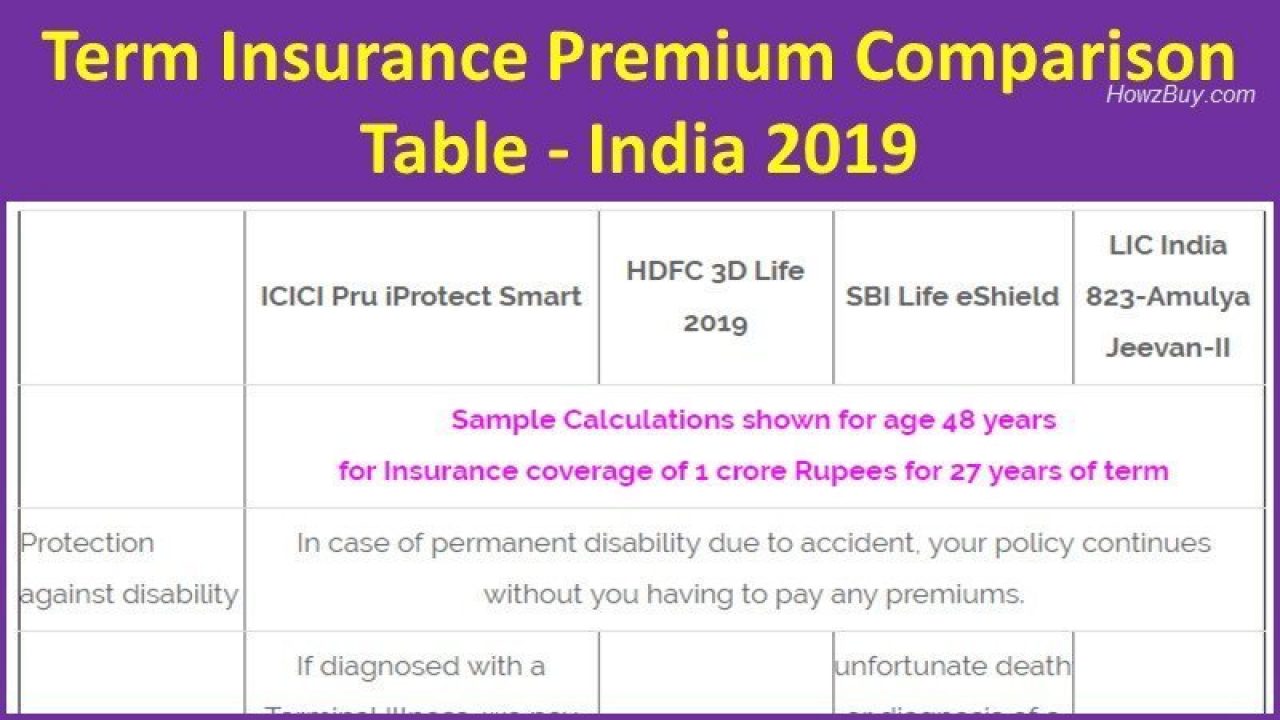

Term Insurance Premium Comparison Table India 2019 Howzbuy India

Term Insurance Premium Comparison Table India 2019 Howzbuy India

Working Adult Guide Term Life Or Whole Life Insurance Which

Working Adult Guide Term Life Or Whole Life Insurance Which

+Insurance.+VUL+is+a+sub-optimal+investment+which+benefits+the+provider+more+than+the+customer.+Buy+term+life+insurance+and+invest+the+difference.png) Personal Finance Apprentice Why I Don T Like Variable Universal

Personal Finance Apprentice Why I Don T Like Variable Universal

Individual Life Insurance Vs Group Term Life Insurance

Individual Life Insurance Vs Group Term Life Insurance

Max Life Term Insurance Plans Compare Online How To Plan Life

Max Life Term Insurance Plans Compare Online How To Plan Life

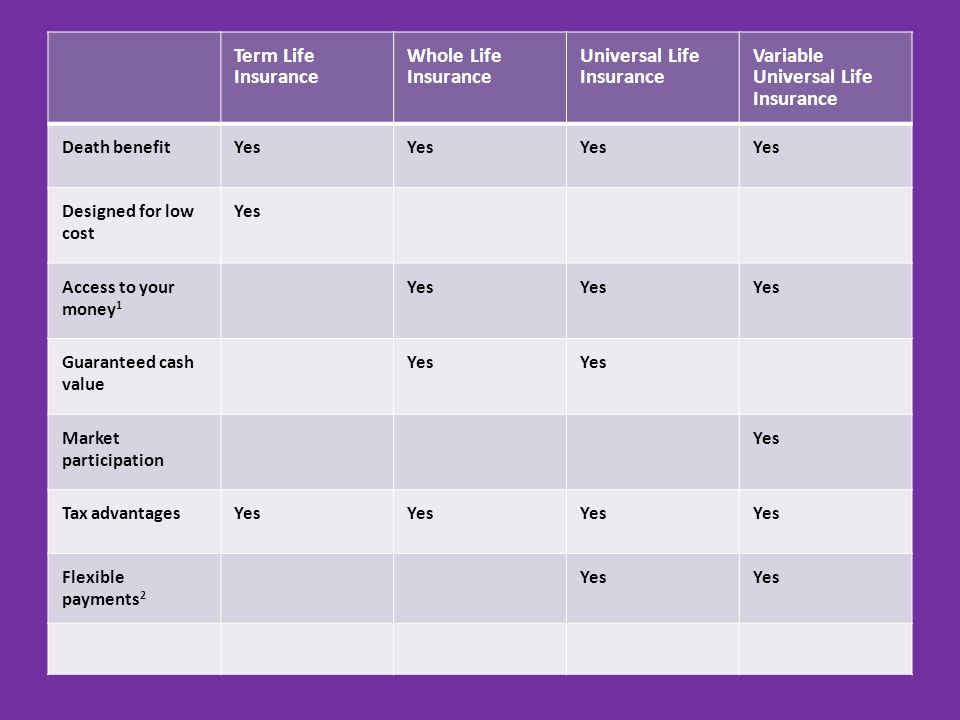

Comparison Between Various Insurance Policies Ppt Download

Comparison Between Various Insurance Policies Ppt Download

Life Insurance Term Versus Whole Waepa

Life Insurance Term Versus Whole Waepa

Compare Life Insurance Options Term Vs Whole Life

Compare Life Insurance Options Term Vs Whole Life

Term Insurance Plans 20 Different Policies Compared With Charts

Term Insurance Plans 20 Different Policies Compared With Charts

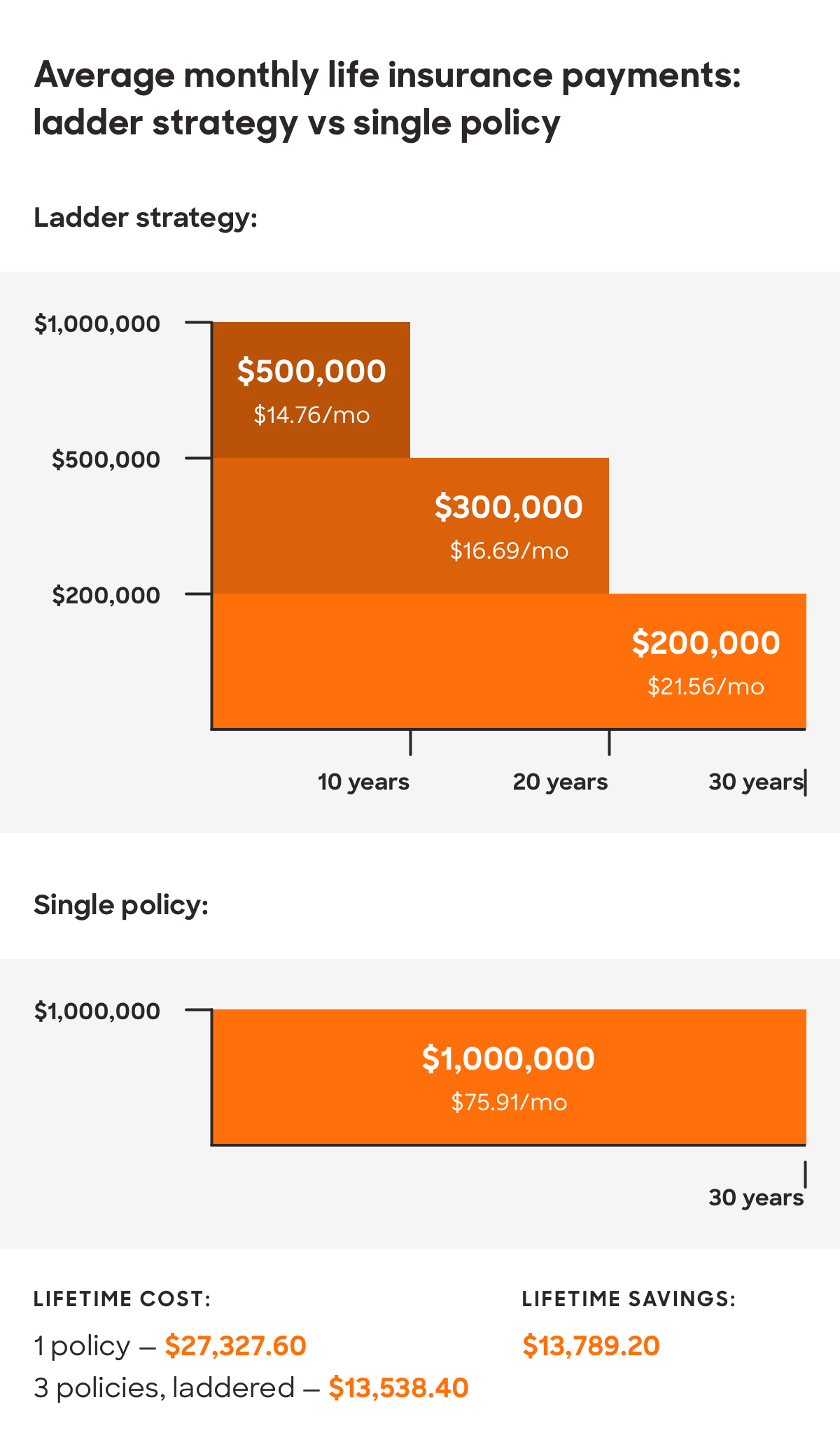

How To Save Money On Life Insurance With The Ladder Strategy

How To Save Money On Life Insurance With The Ladder Strategy

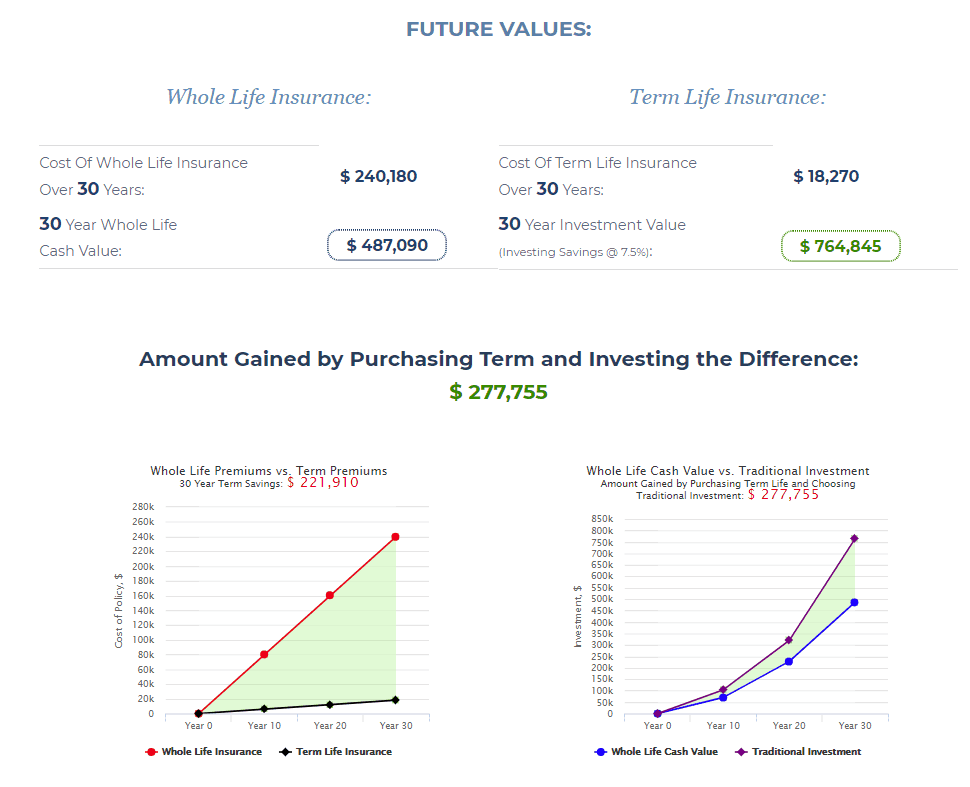

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

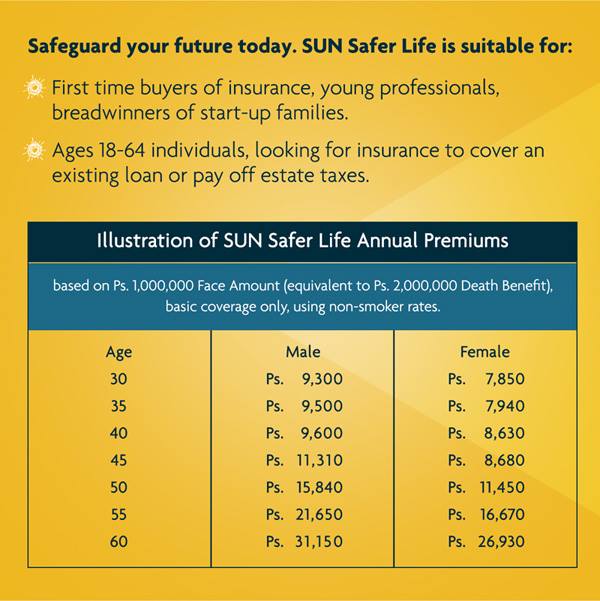

Best And Cheapest Sun Life Term Insurance Plans In The Philippines

Best And Cheapest Sun Life Term Insurance Plans In The Philippines

Whole Life Term Insurance Vs Regular Term Life Insurance Which Is

Whole Life Term Insurance Vs Regular Term Life Insurance Which Is

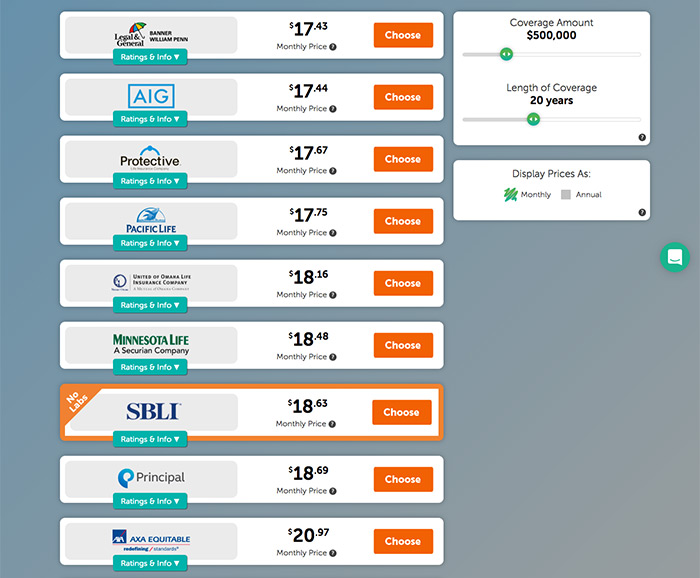

Term Life Insurance Quotes Without Your Personal Information Quotacy

Term Life Insurance Quotes Without Your Personal Information Quotacy

Max Life Term Insurance Compare Best Plan Online Youtube

Max Life Term Insurance Compare Best Plan Online Youtube

:brightness(10):contrast(5):no_upscale()/life-insurance-policy-185263144-5759a4013df78c9b46e39aed.jpg) Comparing Different Types Of Life Insurance

Comparing Different Types Of Life Insurance

Universal Life Insurance Compared To Term Insurance

Universal Life Insurance Compared To Term Insurance

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Ppt Why You Should Compare Life Insurance Quotes Powerpoint

Ppt Why You Should Compare Life Insurance Quotes Powerpoint

Post a Comment for "Compare Insurance Life Term"