Coli Life Insurance

Company owned life insurance coli or corporate owned life insurance is typically taken out on a group of critical employees and pays a benefit when any one of those employees dies. La corporate owned life insurance coli e unassicurazione sulla vita statunitense stipulata sui lavoratori dipendenti e in mano al datore di lavoro con benefici pagabili al datore stesso o direttamente alla famiglia del decedutonomi peggiorativi sono la janitors insurance assicurazione sullinserviente e dead peasants insurance assicurazione sul contadino morto.

Using Corporate Owned Life Insurance Coli To Compete And Retain

Using Corporate Owned Life Insurance Coli To Compete And Retain

When the employee dies the business receives death benefits from the insurer.

Coli life insurance. Because of its tax advantages coli can be an effective financing asset. The business is the beneficiary and the employee is the insured subject of insurance. Pejorative citation needed names for the practice include janitors insurance and dead peasants insurance.

Corporate owned life insurance coli is life insurance on employees lives that is owned by the employer with benefits payable either to the employer or directly to the employees families. When these policies are used and structured properly corporations can offer additional benefits while also anticipating a long term return on investment. Coli life insurance if you are looking for a reliable and free insurance quote then we can help you immediately with our convenient online service.

Coli life insurance if you are looking for insurance for your home car or life then our insurance quotes service can give you quotes to help you find what you need. Corporate owned life insurance is a form of life insurance where the employer is the purchaser beneficiary and owner. The corporation is either the total or partial beneficiary on the policy with benefits payable either to the employer or directly to the employees named beneficiary.

Corporate owned life insurance abbreviated coli is life insurance purchased by a business on the life of an employee. The company purchases and owns a life insurance policy on a key employee and is the primary beneficiary. Corporate owned life insurance coli is an investment alternative to mutual fund scenarios that allow a corporation to accumulate a tax deferred asset.

However current economic conditions can potentially exacerbate some of the risks and challenges associated with coli. Companies often use corporate owned life insurance coli to finance non qualified executive retirement benefits. What is corporate owned life insurance coli.

A specific kind of key man insurance corporate ownership of life insurance is a more complex way of utilizing the lesser known growth and tax advantages of a life insurance policy. The corporation pays non deductible premiums receives tax deferred cash values and receives tax free death benefit proceeds.

Boli Bank Owned Life Insurance The What And The Why

Boli Bank Owned Life Insurance The What And The Why

Corporate Owned Life Insurance Coli Overview Youtube

Corporate Owned Life Insurance Coli Overview Youtube

Corporate Proposed Life Insurance Employee Notification Act

Corporate Proposed Life Insurance Employee Notification Act

Early Cash Value Riders Lifetrends

Early Cash Value Riders Lifetrends

Trc Financial On Twitter Corporate Owned Life Insurance Coli

Trc Financial On Twitter Corporate Owned Life Insurance Coli

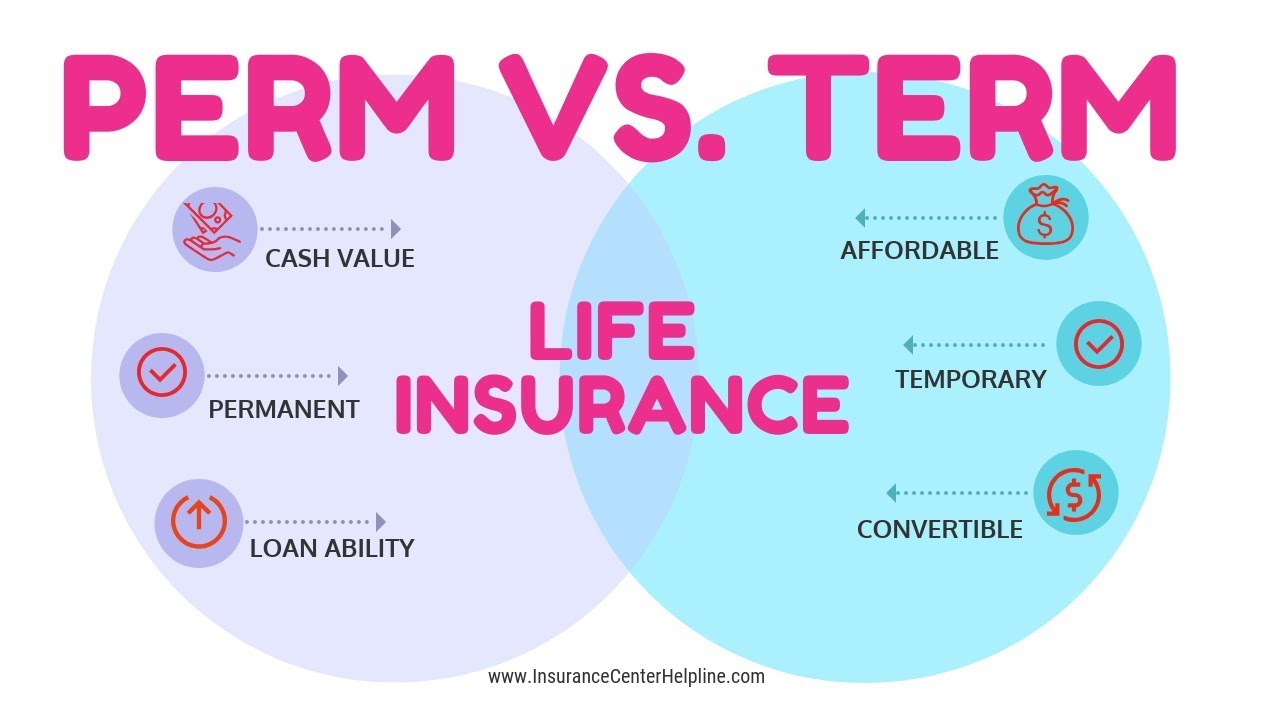

Life Insurance Insurance Center Helpline Inc Insurance

Life Insurance Insurance Center Helpline Inc Insurance

Home Strategic Insurance Solutions

Home Strategic Insurance Solutions

What Is Company Owned Life Insurance Coli Cleverism

What Is Company Owned Life Insurance Coli Cleverism

The Costly Trap Cash Value Enhancement Riders In Coli Policies

The Costly Trap Cash Value Enhancement Riders In Coli Policies

Bank Owned Life Insurance A Primer For Community Banks

Bank Owned Life Insurance A Primer For Community Banks

Bank Owned Life Insurance Boli

Bank Owned Life Insurance Boli

Life Insurance Approval After Colon Polyps What You Must Know

Life Insurance Approval After Colon Polyps What You Must Know

Fillable Online Insurance Il Coli Il Fax Email Print Pdffiller

Fillable Online Insurance Il Coli Il Fax Email Print Pdffiller

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg) Everything You Should Know About Corporate Owned Life Insurance

Everything You Should Know About Corporate Owned Life Insurance

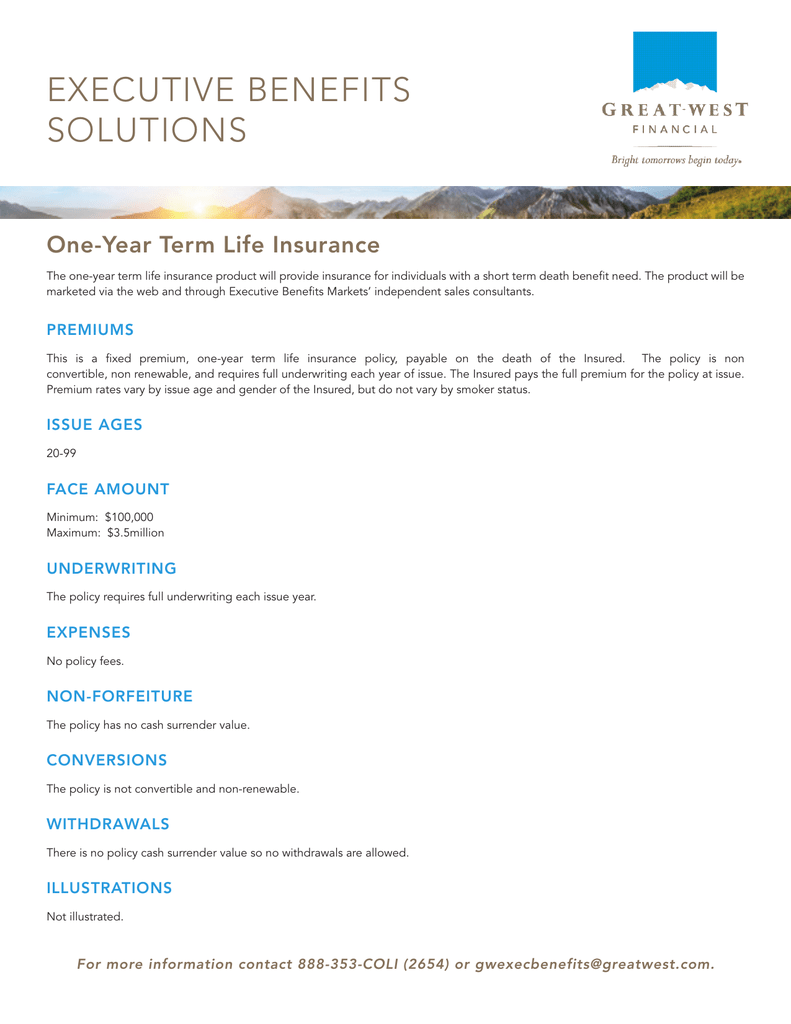

One Year Term Life Insurance Great

One Year Term Life Insurance Great

What Is A Company Owned Life Insurance Policy Coli Youtube

What Is A Company Owned Life Insurance Policy Coli Youtube

Vanbridge Corporate Bank Owned Life Insurance

Vanbridge Corporate Bank Owned Life Insurance

Coli Corporate Owned Life Insurance

Coli Corporate Owned Life Insurance

Form Of Specimen Application For The Majestic Survivorship Vulx

Form Of Specimen Application For The Majestic Survivorship Vulx

Coli Company Owned Life Insurance In Business Finance By

Coli Company Owned Life Insurance In Business Finance By

/life-insurance-policy-185263144-0b47d104cb7347e3ad79da3c2b5de23c-9445d753496441d9aaad09e446e1142b.jpg)

Post a Comment for "Coli Life Insurance"